Loading

Get Al Ador 2848a 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ADoR 2848A online

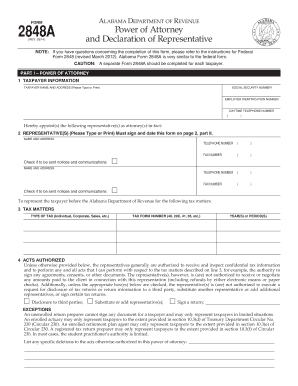

This guide provides comprehensive instructions for completing the AL ADoR 2848A form, which authorizes a representative to act on behalf of a taxpayer in matters before the Alabama Department of Revenue. By following these steps, users can ensure that the form is filled out accurately and submitted efficiently.

Follow the steps to complete the AL ADoR 2848A form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document management tool.

- In Part I, enter the taxpayer information including the taxpayer's name, address, social security number, employer identification number, and daytime telephone number. Ensure all information is accurately typed or printed.

- Appoint the representative(s) by providing their name, address, telephone number, and fax number in the designated section. Mark the option for notices and communications if applicable.

- Specify the tax matters the representative will handle. Fill out the type of tax (e.g., individual, corporate), tax form number, and the specific years or periods for which authorization is granted.

- In the Acts Authorized section, indicate the general powers granted to the representative. If additional powers are required, check the appropriate boxes for disclosure to third parties or signing returns.

- Complete the Retention/Revocation of Prior Power(s) of Attorney section if applicable. If you wish to keep an existing power of attorney in effect, attach a copy and check the relevant box.

- Sign and date the form in the Signature of Taxpayer section, ensuring that the person signing has the authority to execute the document on behalf of the taxpayer.

- In Part II, the representative must complete the Declaration of Representative by selecting the appropriate designation and entering the jurisdiction. Ensure that this section is signed and dated.

- Finally, review the completed form for accuracy. Save your changes, and download it for your records. You can then print or share the form as necessary.

Complete your AL ADoR 2848A form online today to streamline your tax representation process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Obtaining power of attorney for an incapacitated individual in Alabama requires completing the necessary legal forms. It's advisable to consult an attorney to ensure you meet all legal criteria. If you are dealing with related tax matters, including the AL ADoR 2848A, having a power of attorney can simplify decisions regarding tax filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.