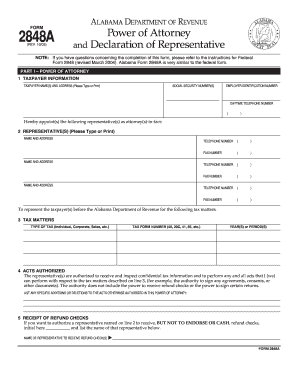

Get Al Ador 2848a 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AL ADoR 2848A online

How to fill out and sign AL ADoR 2848A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax timeframe started unexpectedly or you simply overlooked it, it would likely lead to issues for you. AL ADoR 2848A is not the easiest form, but you have no reason for alarm in any event.

By utilizing our user-friendly service, you will discover the most effective way to complete AL ADoR 2848A even in moments of severe time constraints. All you need to do is adhere to these basic instructions:

With our powerful digital service and its handy tools, completing AL ADoR 2848A becomes more efficient. Don’t hesitate to try it out and spend more time on your interests rather than document preparation.

- Launch the document using our robust PDF editor.

- Provide the necessary information in AL ADoR 2848A, utilizing the fillable fields.

- Add images, marks, check boxes, and text boxes, if desired.

- Repeated information will be auto-filled after the initial entry.

- In case of confusion, utilize the Wizard Tool. You will receive guidance for easier completion.

- Remember to include the filing date.

- Create your unique signature once and apply it in all required spaces.

- Review the information you have entered. Amend any errors as necessary.

- Click on Done to finish editing and select how you will submit it. You can use online fax, USPS, or email.

- You can download the document for later printing or upload it to cloud storage like Dropbox, OneDrive, etc.

How to modify Get AL ADoR 2848A 2005: tailor forms online

Streamline your document preparation process and adapt it to your specifications within moments. Complete and endorse Get AL ADoR 2848A 2005 using a powerful yet user-friendly online editor.

Handling paperwork is consistently challenging, particularly when you handle it sporadically. It requires you to meticulously adhere to all regulations and accurately complete all sections with full and precise information. Nevertheless, it frequently happens that you may wish to alter the document or add additional fields to complete. If you seek to enhance Get AL ADoR 2848A 2005 before submission, the simplest method is by utilizing our powerful yet user-friendly online editing tools.

This all-inclusive PDF editing solution allows you to quickly and effortlessly complete legal documents from any device with internet access, make essential modifications to the template, and incorporate more fillable fields. The service permits you to choose a specific area for each type of data, such as Name, Signature, Currency, and SSN etc. You can designate them as mandatory or conditional and determine who should complete each field by assigning them to a specific recipient.

Follow the steps below to enhance your Get AL ADoR 2848A 2005 online:

Our editor is a versatile multi-functional online solution that can assist you in efficiently and promptly enhancing Get AL ADoR 2848A 2005 along with other forms according to your requirements. Improve document preparation and submission time, and make your documentation appear flawless without complications.

- Access the necessary file from the directory.

- Complete the blanks with Text and use Check and Cross tools on the tickboxes.

- Utilize the right-side toolbar to adjust the form with new fillable sections.

- Choose the fields according to the type of information you wish to collect.

- Set these fields as required, optional, or conditional and customize their sequence.

- Allocate each section to a specific party using the Add Signer feature.

- Verify if you've made all the essential modifications and click Done.

Related links form

Generally, form 2848 does not require notarization unless specified by the state laws or particular circumstances. However, if the form includes actions requiring first-hand verification, a notary's signature may be necessary. Always check the most current legal guidelines or use resources like AL ADoR 2848A to verify what is required for your specific situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.