Get Irs 14039 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14039 online

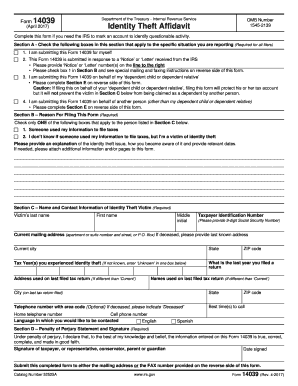

The IRS 14039, also known as the identity theft affidavit, is a crucial document for individuals who need to report identity theft to the Internal Revenue Service. This guide provides clear, step-by-step instructions to help you fill out the form online efficiently and accurately.

Follow the steps to complete your IRS 14039 online

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In Section A, check the boxes that apply to your situation. Indicate whether you are submitting the form for yourself, in response to a notice from the IRS, for a dependent, or on behalf of another person.

- In Section B, select one reason for filing the form. You must check only one box that describes the identity theft issue you are reporting.

- Proceed to Section C to provide the name and contact information of the identity theft victim. Fill in the required fields, including the victim's last name, first name, middle initial, Social Security Number, and current mailing address.

- Complete any relevant fields regarding the tax years affected by the identity theft, the last year a return was filed, and any names or addresses used on past returns.

- In Section D, sign and date the form to affirm that the information provided is true and correct under penalty of perjury.

- If you are submitting the form on behalf of someone else, complete Section E by selecting the appropriate box and providing relevant information about your relationship to the victim.

- Finally, review all the filled-in information for accuracy. After reviewing, save the changes, download, print, or share the form as needed.

Complete your IRS 14039 document online to ensure your identity theft concerns are addressed promptly.

Get form

To talk to a live person at the IRS, you can call their helpline at 1-800-829-1040. Make sure to have your personal information ready for verification purposes. If you are dealing with identity theft issues, it’s important to have your Form 14039 information accessible during the call. USLegalForms provides resources that can prepare you before reaching out to the IRS.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.