Get Al Ador 40 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ADoR 40 online

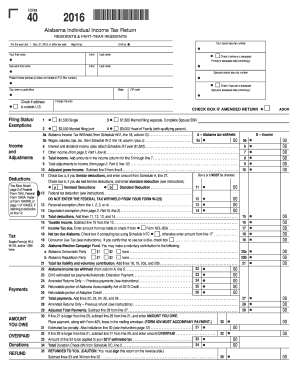

Filling out the AL ADoR 40 online is a straightforward process designed for Alabama residents and part-year residents to file their individual income tax returns efficiently. This guide provides a detailed walkthrough of each section of the form to help you complete it accurately.

Follow the steps to effectively complete your AL ADoR 40 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Enter your social security number, ensuring it is accurate, as this is critical for tax processing.

- Provide your first and last name along with any initials; you also need to check the box if the primary taxpayer is deceased and enter the date of death if applicable.

- Fill in your spouse's information including their first name, social security number, and check the box if they are deceased, along with the date of death.

- Complete your present home address including the street address, city, state, ZIP code, and any indication that the address is outside the U.S. if applicable.

- Select your filing status from the options provided: single, married filing separately, married filing jointly, or head of family.

- Input the details of your income by entering the amounts from your W-2 forms or other income sources as instructed on the form.

- If applicable, calculate and enter any adjustments to your income, including deductions from IRA contributions or health savings accounts.

- Review and enter your deductions; if claiming itemized deductions, attach the necessary schedules as instructed.

- Calculate the total tax due based on your income and deductions, and provide the necessary details regarding any payments already made.

- Ensure you sign the return in the designated area, and if filing jointly, your spouse must also sign.

- Review all entries for accuracy, and if everything is correct, you can save your changes, download the completed form, and prepare it for submission.

Start filing your AL ADoR 40 online today for a smooth and efficient tax return process.

Get form

To file Form 40 in Alabama, you will typically send it to the Alabama Department of Revenue. Ensure you review the specific filing instructions, including deadlines and any required documents. Filing online can streamline the process, and using resources like the AL ADoR 40 helps ensure compliance. US Legal Forms also provides relevant templates to simplify your filing experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.