Loading

Get Irs 14310 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14310 online

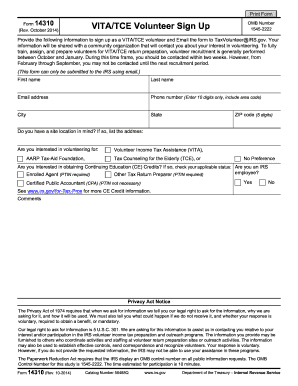

Filling out the IRS 14310 form online can be a straightforward process when you follow the right steps. This guide provides a detailed overview of the form, ensuring you have the necessary information to complete it successfully.

Follow the steps to complete the IRS 14310 form online.

- Click ‘Get Form’ button to access the IRS 14310 form online.

- In the first section, enter your first name and last name accurately in the designated fields.

- Provide your email address to enable correspondence regarding your volunteer application.

- Input your phone number, ensuring it consists of 10 digits including your area code.

- Fill in your city, state, and 5-digit ZIP code in the appropriate fields.

- If you have a specific site location in mind for volunteering, enter the address in the provided space.

- Indicate your interest in volunteer programs by selecting one of the options: AARP Tax-Aid Foundation, Volunteer Income Tax Assistance (VITA), Tax Counseling for the Elderly (TCE), or No Preference.

- If you wish to obtain Continuing Education Credits, check the applicable status that fits your role (IRS employee, Enrolled Agent with PTIN, Other Tax Return Preparer with PTIN, Certified Public Accountant, or select No).

- Use the comments section to add any additional information or questions you may have.

- Once all fields are completed, review your information for accuracy before submitting. Save any changes, download, or email the form as needed to TaxVolunteer@IRS.gov.

Start filling out your IRS 14310 form online today to contribute to your community.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out Form 3911 for your stimulus check, gather your personal information, including your Social Security number, address, and filing status. Follow the instructions on the form carefully, ensuring you provide accurate details to avoid processing delays. For further assistance with this form and insights on navigating through IRS 14310, consider exploring the resources on the US Legal Forms platform.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.