Loading

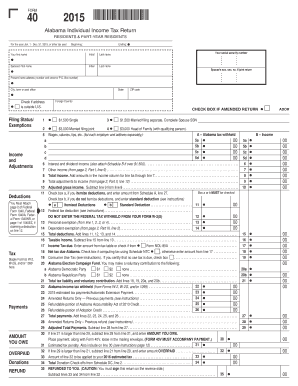

Get Al Ador 40 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ADoR 40 online

Filling out the Alabama Individual Income Tax Return (AL ADoR 40) online can streamline the process and ensure accurate submissions. This guide offers an easy-to-follow approach to completing each section of the form, making it accessible for all users, regardless of their legal experience.

Follow the steps to complete your AL ADoR 40 online.

- Click ‘Get Form’ button to access the AL ADoR 40 form in an online format.

- Begin by entering your personal information in the designated fields. Include your first name, middle initial, and last name, along with your Social Security number.

- Input your spouse's first name and Social Security number if you are filing a joint return. Be sure to check the applicable filing status box based on your situation.

- Provide your current home address, ensuring accuracy in the street number, city, state, and ZIP code fields. Check the box if your address is outside the United States.

- Report your income and any applicable adjustments in the relevant sections, including wages, salaries, tips, and other income sources.

- Complete the deductions section by indicating whether you are itemizing your deductions or taking the standard deduction. Add any attachments if required.

- Proceed to calculate your total tax liability and any payments made, including taxes withheld and estimated payments.

- If applicable, indicate whether this is an amended return and provide necessary details about previous payments or refunds.

- Sign and date the return. If filing jointly, ensure both you and your spouse provide signatures.

- Finally, review all entries for accuracy. Once completed, save any changes, and proceed to download or print the form if needed.

Complete your AL ADoR 40 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Choosing between claiming 1 or 0 allowances depends on your unique financial scenario. Claiming 0 will result in higher tax withholdings, potentially leading to a refund at tax time, while claiming 1 may allow for more disposable income throughout the year. Evaluate your situation according to AL ADoR 40 advice to determine the best choice for you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.