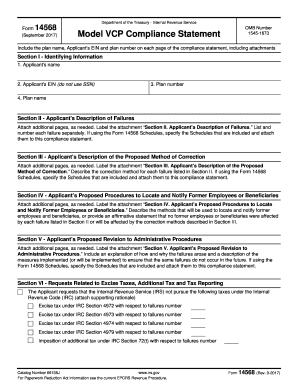

Get Irs 14568 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 14568 online

How to fill out and sign IRS 14568 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When you aren't linked to document management and legal operations, submitting IRS documents can be exceedingly exhausting.

We recognize the significance of accurately completing documents.

Utilizing our platform will turn expert filling of IRS 14568 into a reality. We will ensure everything for your convenience and ease of work.

- Press the button Get Form to open it and begin editing.

- Fill in all necessary fields in the chosen document with our beneficial PDF editor. Activate the Wizard Tool to simplify the process.

- Verify the accuracy of the information provided.

- Add the date of filling IRS 14568. Use the Sign Tool to create your unique signature for the document validation.

- Finish editing by clicking Done.

- Submit this document directly to the IRS in the most suitable way for you: via email, using virtual fax, or postal service.

- You can print it out on paper if a copy is required and download or save it to your preferred cloud storage.

How to Alter Get IRS 14568 2017: Tailor Forms Online

Eliminate disarray from your documentation habits. Uncover the most efficient method to locate, modify, and submit a Get IRS 14568 2017.

The task of preparing Get IRS 14568 2017 necessitates precision and focus, particularly for those who are not well-acquainted with this type of work. It is crucial to obtain an appropriate template and populate it with the accurate details. With the right solution for managing documents, you can access all the tools you need. It is straightforward to streamline your editing tasks without acquiring new skills. Find the suitable example of Get IRS 14568 2017 and fill it out immediately without switching between your browser tabs. Explore additional tools to modify your Get IRS 14568 2017 form in the editing mode.

While on the Get IRS 14568 2017 page, simply click the Get form button to begin altering it. Input your details to the form right away, as all the necessary tools are available right here. The sample is pre-arranged, requiring minimal effort from the user. Utilize the interactive fillable fields in the editor to effortlessly complete your documentation. Just click on the form and move to the editor mode without hesitation. Fill in the interactive field, and your document is ready.

Explore more tools to personalize your form:

Often, a minor mistake can spoil the entire form when filled manually. Eliminate inaccuracies in your documentation. Quickly locate the samples you need and complete them digitally using a smart editing solution.

- Surround the document with additional text if required. Use the Text and Text Box tools to place text in a separate box.

- Incorporate pre-designed graphical elements like Circle, Cross, and Check using the respective tools.

- If necessary, capture or upload images into the document employing the Image feature.

- If you want to sketch within the document, utilize the Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout tools to modify text in the document.

- If comments are needed for specific sections of the document, click the Sticky tool and place a note in the desired location.

Related links form

The voluntary fiduciary correction program allows fiduciaries to correct errors or failures related to retirement plans without facing penalties. This program is beneficial as it promotes compliance and helps fiduciaries address mistakes proactively. To understand how IRS 14568 intersects with this program, you can explore resources available through US Legal Forms to ensure you are on the right track and fully compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.