Get Irs 2032 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2032 online

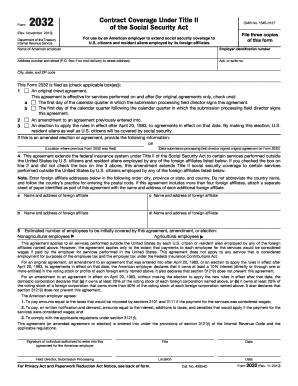

Filling out the IRS 2032 form is a crucial step for American employers seeking to extend social security coverage to U.S. citizens and resident aliens employed by their foreign affiliates. This guide provides clear, step-by-step instructions to help you navigate the process efficiently.

Follow the steps to fill out the IRS 2032 online.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Enter the name of the American employer in the designated field. Make sure this matches the official name used in business registrations.

- Input the employer identification number (EIN) accurately as displayed on Form 941 to expedite processing.

- Provide the complete address, including number, street name, unit number if applicable, city, state, and ZIP code.

- Select and check the applicable box to indicate whether this is an original agreement, an amendment, or an election to apply updated rules.

- If applicable, enter the location where any previous Form 2032 was filed and the date the submission processing field director signed the original agreement.

- List the foreign affiliates that are part of this agreement, ensuring to enter each address in the specified order without abbreviating country names.

- Indicate the estimated number of employees to be covered, distinguishing between nonagricultural and agricultural employees.

- Ensure that a person authorized to represent the employer signs and dates the agreement, including their title.

- Complete and sign three copies of the form, ensuring that each has the necessary evidence of authority attached.

- Submit the form by mailing it in triplicate to the Internal Revenue Service at the appropriate address.

Now that you have a comprehensive guide, start filling out your IRS 2032 form online today.

To fill out a letter to the IRS, start with your contact information at the top, including your name, address, and Social Security number. Next, clearly state the purpose of your letter, including any relevant details about IRS Form 2032 if applicable. Finally, sign the letter and include the date before mailing it to the appropriate IRS address. Ensuring clarity helps the IRS process your request efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.