Loading

Get Irs 2032 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2032 online

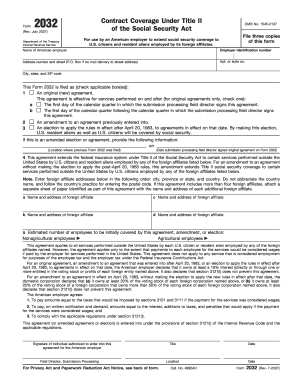

Filling out the IRS Form 2032 is a crucial step for American employers seeking to extend social security coverage to U.S. citizens and resident aliens employed by foreign affiliates. This guide provides clear, step-by-step instructions tailored to help users complete the form accurately online.

Follow the steps to fill out the IRS 2032 online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering the name of the American employer in the designated field, followed by the employer identification number. Ensure that this number reflects accurately to facilitate IRS processing.

- Input the physical address of the employer, including the street number and name, apartment or suite number, city, state, and ZIP code.

- Indicate whether this is an original agreement, an amendment, or an election by selecting the appropriate checkbox in section 1.

- If filing an original agreement, select when the agreement becomes effective by checking either option 1a or 1b based on your preference.

- For amendments or elections, provide the necessary previous filing information, including the location and date the previous Form 2032 was filed.

- List the names and addresses of the foreign affiliates to which this agreement applies. Ensure that you include all required information according to the specified format.

- Estimate the number of employees initially covered by the agreement, distinguishing between nonagricultural and agricultural employees.

- Complete the declaration in section 4, affirming ownership interests as required based on the types of agreements being filed.

- Sign and date the form in the designated area. Include the title and location of the signatory to confirm authority.

- Once completed, save the changes to the form. You may also choose to download, print, or share the finalized form as needed.

Start filling out your IRS 2032 form online today to ensure compliance and coverage.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out a letter to the IRS requires clear communication of your issue or question. Start by stating your tax identification details, followed by the purpose of your letter. Incorporating information regarding IRS 2032 can clarify the context of your inquiry or request. For templates and examples, check out the resources available at USLegalForms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.