Loading

Get Irs 2106 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2106 online

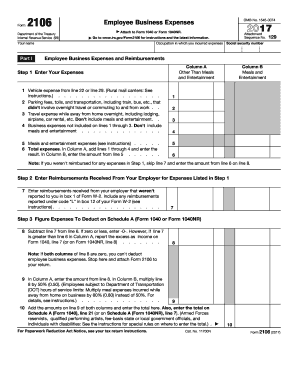

Filling out the IRS Form 2106 is crucial for individuals seeking to deduct employee business expenses on their tax returns. This guide will walk you through each section of the form, providing clear instructions to ensure a smooth and accurate submission.

Follow the steps to complete your IRS 2106 form.

- Click ‘Get Form’ button to obtain the IRS 2106 form and open it in the editor.

- Enter your name and Social Security number at the top of the form.

- In Part I, fill in your occupation where you incurred expenses and begin detailing your employee business expenses in Column A for other than meals and entertainment.

- For line 1, input your vehicle expense from the relevant prior section. For line 2, list any parking fees, tolls, and other transportation costs that did not involve overnight travel or commuting.

- On line 3, include your travel expenses incurred while away from home overnight, ensuring to omit any meals and entertainment.

- Continue to line 4 to add any additional business expenses not covered in previous lines, still excluding meals and entertainment.

- For line 5, enter any meals and entertainment expenses, then calculate the total for Column A on line 6 by summing lines 1 through 4.

- In Column B, enter the amount from line 5, representing meals and entertainment expenses.

- If you received reimbursements from your employer, fill those in on line 7, ensuring they were not previously reported in box 1 of your Form W-2.

- On line 8, subtract the amount in line 7 from line 6. If the result is zero or less, enter -0-.

- Enter the result from line 8 back into Column A. If applicable, multiply line 8 by 50% for Column B.

- Add the values from line 9 of both columns and place the total on line 10. This total will also be needed for your Schedule A.

- In Part II, Section A, enter vehicle information including the date the vehicle was placed in service and total miles driven during the tax year.

- Fill in business miles, percentage of business use, and any relevant commuting details. Answer yes or no to questions about vehicle usage during off-duty hours.

- If using Section B, utilize the standard mileage rate by multiplying your business miles by 53.5 cents to detail costs in the appropriate fields.

- Once all information is filled, review your entries for accuracy, then save your changes, download the form, print it, or share it as needed.

Start filling out your IRS 2106 form online today to ensure you can deduct your eligible business expenses!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To enter Form 2106 in TurboTax, navigate to the 'Deductions & Credits' section of the software. Look for the business expenses section, where you can input the information from your IRS Form 2106. TurboTax will guide you through the necessary steps to ensure you receive your deductions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.