Loading

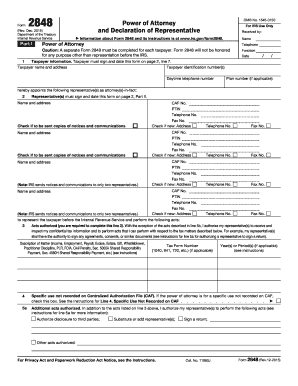

Get Irs 2848 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2848 online

The IRS 2848 form, also known as the Power of Attorney and Declaration of Representative, allows taxpayers to appoint a representative to act on their behalf before the Internal Revenue Service. This guide provides clear, step-by-step instructions on how to complete the form online.

Follow the steps to fill out the IRS 2848 online

- Press the ‘Get Form’ button to access the IRS 2848 form and open it for editing.

- In Part I of the form, provide your taxpayer information. Enter your name, address, and taxpayer identification number (TIN). Make sure to include your daytime telephone number.

- Below the taxpayer information, appoint your representative(s). List their names and addresses, and if applicable, check the box to send copies of notices and communications.

- In line 3, specify the acts authorized for your representative(s). This is necessary to allow your representative(s) to access your confidential tax information and perform tasks on your behalf.

- If there are any additional acts you authorize, note them in line 5a. You can also check the box if there are specific acts not authorized in line 6.

- Signature and date are required in line 7. Taxpayers must sign and date the form to validate it.

- In Part II, the representative must complete the Declaration of Representative section. They should provide their designation, licensing jurisdiction, and sign the form.

- Once all information is completed and reviewed, save your changes. You can then download, print, or share the form as needed.

Complete your IRS 2848 form online today to ensure proper representation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To submit your Power of Attorney (POA) to the IRS, you can mail form 2848 to the appropriate IRS address listed in the instructions. Alternatively, you might opt to fax the form if you are following specified IRS guidelines. This ensures your submission is tracked efficiently. USLegalForms can offer tips on the most effective submission methods for your circumstances.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.