Loading

Get Al Ador Al8453-c 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ADoR AL8453-C online

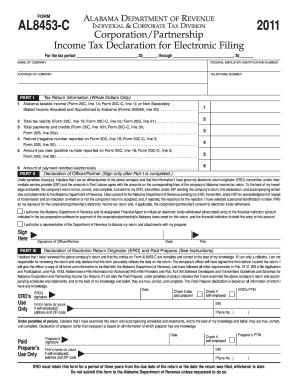

The AL ADoR AL8453-C is an essential form for corporations and partnerships to declare their income tax for electronic filing in Alabama. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the AL ADoR AL8453-C online successfully.

- Click 'Get Form' button to obtain the AL ADoR AL8453-C and open it in your preferred document editor.

- In the first section, enter the name of your company as it appears on official documents. Include the federal employer identification number, complete address, and telephone number.

- Proceed to Part I. Here, you will declare your Alabama taxable income. Fill in line 1 with the amount from the appropriate tax form, ensuring it reflects whole dollars only.

- Next, complete line 2 by entering your total tax liability based on the specified lines from the applicable forms.

- On line 3, provide the total payments and credits recorded on the appropriate lines of your tax forms.

- For line 4, report any refund amount as a negative figure as indicated in the instructions.

- Fill line 5 with the amount you owe, ensuring it is a positive number associated with your tax liability.

- Enter the amount of payment you are remitting electronically in line 6.

- Once Part I is completed, move onto Part II. Here, the officer or partner must sign under the declaration, confirming the information is accurate and complete.

- In Part III, if there is an Electronic Return Originator (ERO) involved, they must provide their details and sign, affirming the accuracy of the information. If applicable, a paid preparer's information should also be filled in.

- After completing the entire form, make sure to save your changes. You can then download, print, or share the document as required.

Complete your documents online to ensure a smooth filing process.

Related links form

Yes, you can file a 1099C electronically, and it's vital to follow the proper procedures. Using services like uslegalforms simplifies the process of submitting your 1099C and ensures compliance with IRS guidelines. Don't forget that this form is used to report cancellation of debt, so make sure you have all relevant information handy, including the details required for the AL ADoR AL8453-C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.