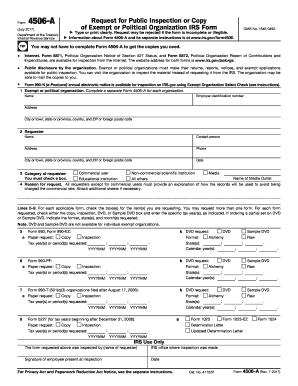

Get Irs 4506-a 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 4506-A online

How to fill out and sign IRS 4506-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When individuals aren't connected with document management and legal procedures, submitting IRS documents can be exceptionally daunting. We recognize the importance of accurately completing documents. Our platform offers the solution to simplify the process of submitting IRS documents as effortlessly as possible. Adhere to these instructions to precisely and swiftly submit IRS 4506-A.

How you can submit the IRS 4506-A online:

Utilizing our platform will transform the expert filling of IRS 4506-A into a reality. We will do everything necessary for your comfortable and efficient work.

- Click the button Get Form to open it and begin editing.

- Complete all necessary fields in the chosen document using our user-friendly PDF editor. Activate the Wizard Tool to make the process even easier.

- Ensure the accuracy of the filled information.

- Include the date of completion for IRS 4506-A. Utilize the Sign Tool to create a unique signature for document validation.

- Finish editing by clicking Done.

- Submit this file to the IRS in the most convenient manner for you: via email, using digital fax, or postal service.

- You have the option to print it out on paper if a hard copy is required and download or save it to your preferred cloud storage.

How to Modify Get IRS 4506-A 2017: tailor documents on the web

Choose a trustworthy document editing service that you can rely on. Modify, complete, and verify Get IRS 4506-A 2017 safely online.

Often, dealing with documents like Get IRS 4506-A 2017 can present difficulties, particularly if you received them digitally but lack access to specific software. While there are alternative methods to handle it, you risk producing a form that fails to meet submission standards. Moreover, using a printer and scanner is not a viable option due to time and resource constraints.

We provide a simpler and more efficient method for finishing documents. A vast collection of form templates that are simple to modify and verify, and can be made fillable for others. Our solution goes far beyond just templates. One of the greatest advantages of using our service is that you can edit Get IRS 4506-A 2017 directly on our site.

Being a web-based service, it saves you from the necessity of downloading any software. Additionally, not all company policies allow you to download it on your work laptop. Here’s how you can effortlessly and securely complete your documents with our platform.

Eliminate the need for paper and other inefficient methods of handling your Get IRS 4506-A 2017 or other documents. Opt for our solution instead, which combines one of the most extensive libraries of customizable templates and a robust document editing option. It's user-friendly and secure, and can save you considerable time! Don’t just take our word for it, try it for yourself!

- Click the Get Form > you’ll be quickly redirected to our editor.

- Once opened, you can initiate the editing procedure.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Select the date option to insert a specific date into your template.

- Include text boxes, images, notes, and more to enhance the content.

- Use the fillable fields option on the right to add fillable {fields.

- Click Sign from the top toolbar to create and include your legally-binding signature.

- Press DONE and save, print, share or download the final {file.

The IRS 4506-T form is used to request a transcript of your tax return, which is different from a copy of the return itself. Many lenders ask for this form to quickly verify your income without needing an extensive review of documents. It simplifies the verification process for both parties involved. US Legal Forms can help you navigate this requirement with ease and efficiency.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.