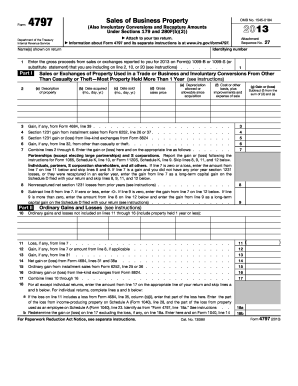

Get Irs 4797 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 4797 online

How to fill out and sign IRS 4797 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When people aren't linked with document management and legal processes, completing IRS forms can be quite challenging. We understand the importance of accurately filling out forms.

Our online application offers the solution to simplify the submission of IRS documents as straightforward as possible. Adhere to this guide to swiftly and precisely file IRS 4797.

Using our online application can truly make professional completion of IRS 4797 achievable. Everything is designed for your convenience and ease of work.

- Click the button Get Form to access it and begin editing.

- Complete all necessary fields in the chosen document using our robust and user-friendly PDF editor. Activate the Wizard Tool to complete the process even more effortlessly.

- Ensure the accuracy of the information entered.

- Add the date of completing IRS 4797. Utilize the Sign Tool to create your personal signature for document validation.

- Conclude editing by selecting Done.

- Submit this document directly to the IRS in the most convenient way for you: via email, using virtual fax, or postal service.

- You can print it out on paper if a copy is required and download or save it to your preferred cloud storage.

How to Modify Fillable IRS 4797 2013: Personalize Forms Online

Forget the conventional paper-based method of filling out IRS 4797 2013. Get the form completed and verified swiftly with our expert online editor.

Are you struggling to alter and complete IRS 4797 2013? With a powerful editor like ours, you can accomplish this in just minutes without the hassle of printing and scanning documents back and forth. We provide fully modifiable and simple form templates that will act as an initial framework and assist you in finishing the required document online.

All forms automatically feature fillable fields ready for completion once you access the document. However, if you wish to enhance the current content of the document or introduce new elements, you can choose from a range of editing and commenting features. Emphasize, obscure, and provide feedback on the document; include checkmarks, lines, text boxes, graphics, notes, and remarks. Moreover, you can quickly validate the document with a legally-recognizable signature. The finished document can be shared with others, stored, imported into external applications, or converted into other formats.

You can’t go wrong by selecting our web-based tool to finalize IRS 4797 2013 because it is:

Don’t waste time finalizing your IRS 4797 2013 the outdated way - with pen and paper. Utilize our comprehensive solution instead. It provides an extensive array of editing tools, integrated eSignature features, and user-friendliness. What differentiates it is the team collaboration capabilities - you can collaborate on forms with anyone, establish a well-organized document approval process from the ground up, and much more. Experience our online solution and gain the best value for your investment!

- Simple to set up and operate, even for those who haven't filled out documents online before.

- Robust enough to accommodate various editing requirements and form categories.

- Safe and secure, ensuring your editing process is protected every time.

- Accessible on a variety of operating systems, making it easy to complete the form from anywhere.

- Able to create forms based on pre-drafted templates.

- Compatible with many file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Transactions that involve the sale or exchange of business property must be included on IRS Form 4797. This includes sales of real estate, equipment, and machinery that your business has used for operations. By detailing these transactions on IRS 4797, you can accurately report any gains or losses. Use this form to represent business asset transactions effectively and meet IRS requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.