Loading

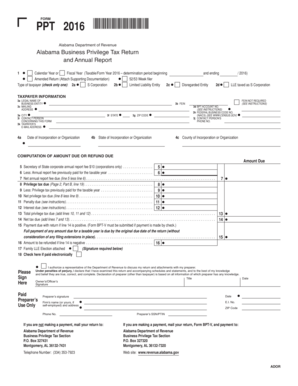

Get Al Ador Ppt 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ADoR PPT online

Filling out the Alabama Business Privilege Tax Return and Annual Report (AL ADoR PPT) can seem daunting. However, with this comprehensive guide, you will navigate the process with ease and confidence.

Follow the steps to accurately complete the AL ADoR PPT online.

- Press the 'Get Form' button to access the form and open it in the editing tool of your choice.

- Begin by selecting the appropriate taxable year. Indicate whether you are filing for the calendar year or a fiscal year, specifying the start and end dates as required.

- In the taxpayer information section, fill in the legal name of the business entity and provide the Federal Employer Identification Number (FEIN) followed by the Business Privilege Tax (BPT) account number if applicable. Ensure that you include the mailing address, city, state, ZIP code, and the contact person’s details including their email and phone number.

- Complete the computation of amount due or refund expected. For each item, such as the corporate annual report fee, privilege tax due, and any penalties or interest, make sure to fill in the respective amounts, calculating totals accurately.

- If applicable, check the box indicating if an amendment is being filed and attach any supporting documentation that is required to substantiate these changes.

- Sign and date the document as required, ensuring that the declaration acknowledges the accuracy of the information provided.

- Lastly, review all fields for accuracy. You can then save your changes, download the completed form for printing, or directly share it as necessary.

Start filling out your AL ADoR PPT online today to ensure timely compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, Alabama allows extensions for filing the Business Privilege Tax under certain circumstances. However, you typically must apply for the extension before the original due date. Awareness of these provisions can help you manage your deadlines effectively in relation to AL ADoR PPT.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.