Get Irs 4972 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 4972 online

How to fill out and sign IRS 4972 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If you are not linked with document management and legal processes, filing IRS paperwork can be rather exhausting. We understand the importance of accurately completing forms.

Our web-based application provides the means to simplify the process of filing IRS paperwork as much as possible.

Utilizing our robust solution will turn expert completion of IRS 4972 into a reality. Make everything for your comfortable and secure work.

- Select the button Get Form to access it and begin editing.

- Complete all required fields in the chosen document using our convenient PDF editor. Activate the Wizard Tool to make the process even easier.

- Ensure the accuracy of the entered information.

- Add the date of submitting IRS 4972. Use the Sign Tool to create your personal signature for document validation.

- Conclude the editing process by clicking Done.

- Send this document to the IRS in the most convenient way for you: via email, digital fax, or by mail.

- You can print it if a physical copy is necessary and download or save it to your preferred cloud service.

How to modify Get IRS 4972 2018: personalize forms online

Utilize the functionality of the versatile online editor while completing your Get IRS 4972 2018. Take advantage of the variety of tools to quickly fill in the blanks and provide the required information instantly.

Preparing documents is time-consuming and costly unless you possess ready-to-use fillable templates and complete them digitally. The easiest method to handle the Get IRS 4972 2018 is by using our expert and versatile online editing solutions. We equip you with all the necessary tools for swift form completion and permit you to make any modifications to your forms, tailoring them to any specifications. Furthermore, you can add remarks on the changes and leave notes for other participants involved.

Here’s what you are able to do with your Get IRS 4972 2018 in our editor:

Sharing the document in various manners and saving it on your device or the cloud in different formats once you have completed editing makes managing the Get IRS 4972 2018 in our robust online editor the quickest and most efficient way to handle, submit, and share your paperwork as required from anywhere. The tool operates from the cloud so you can access it from any location on any device connected to the internet. All forms you generate or fill out are securely stored in the cloud, allowing you to access them whenever necessary with the assurance of not losing them. Stop wasting time on manual document completion and eliminate physical papers; make it all online with minimal effort.

- Fill in the empty fields using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize critical details with a preferred color or underline them.

- Conceal sensitive information with the Blackout feature or simply erase it.

- Insert images to illustrate your Get IRS 4972 2018.

- Substitute the original text with the one that meets your needs.

- Include comments or sticky notes to engage with others about the updates.

- Add extra fillable sections and assign them to specific recipients.

- Secure the document with watermarks, place dates, and bates numbers.

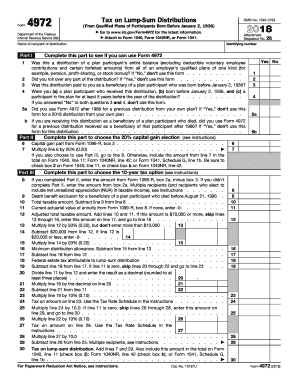

You can find information about taxes on lump-sum distributions in the IRS guidelines and specifically in the instructions for form 4972. This form outlines how to calculate and report taxes owed on your distribution. Additionally, online resources and tools can help simplify this process and provide clarity on your financial responsibilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.