Loading

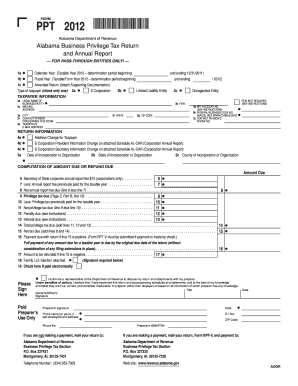

Get Al Ador Ppt 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ADoR PPT online

This guide will provide a clear and supportive instruction set for users on how to fill out the Alabama Department of Revenue Pass-Through Entity Privilege Tax Return (AL ADoR PPT) online. Follow these steps to ensure a comprehensive and accurate submission.

Follow the steps to complete the AL ADoR PPT online effectively.

- Press the ‘Get Form’ button to access the AL ADoR PPT and open it in the editor.

- Select the appropriate taxable year by checking one of the options: Calendar Year, Fiscal Year, or Amended Return.

- Indicate the type of taxpayer by selecting one of the following options: S Corporation, Limited Liability Entity, or Disregarded Entity.

- Fill in the taxpayer information, including the legal name of the business, mailing address, FEIN, BPT account number, federal business code number, contact person information, and email address.

- Complete the Return Information section, checking if there are any address changes or personnel information changes, and provide the date and place of incorporation.

- Navigate to the Computation of Amount Due or Refund Due section and calculate the amounts due based on previous payments and applicable fees. Fill in all relevant fields including penalties or interest if applicable.

- In the signature area, ensure that the person authorized declares the return's correctness with their title and signature.

- Once all fields are filled out, review the form for accuracy, then save your changes. You may also download, print, or share the form as needed.

Complete and file the AL ADoR PPT online to ensure compliance and timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Certain entities may be exempt from Alabama's Business Privilege Tax (BPT). This typically includes non-profit organizations, some government entities, and small businesses below a specified income threshold. It's essential to check the requirements to confirm your eligibility for exemption. If you think your business qualifies, uslegalforms can assist you in determining your tax status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.