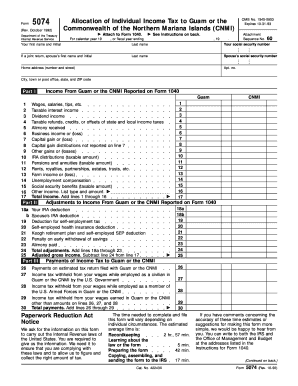

Get Irs 5074 1992

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5074 online

How to fill out and sign IRS 5074 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When people aren’t connected to document management and legal procedures, completing IRS forms can be rather difficult. We understand the importance of accurately finalizing documents. Our online application provides the solution to streamline the process of processing IRS forms as effortlessly as possible. Follow these instructions to swiftly and correctly complete IRS 5074.

How to complete the IRS 5074 online:

Utilizing our platform will enable professional completion of IRS 5074. We will ensure everything for your comfortable and secure operation.

- Click on the button Get Form to access it and begin editing.

- Fill all required fields in the document using our robust and user-friendly PDF editor. Activate the Wizard Tool to simplify the process significantly.

- Verify the accuracy of the entered information.

- Include the date of completing IRS 5074. Utilize the Sign Tool to create your signature for record validation.

- Conclude the editing by clicking on Done.

- Submit this document directly to the IRS in the most convenient manner for you: through email, using virtual fax, or by postal service.

- You can print it out on paper when a copy is necessary and download or save it to your preferred cloud storage.

How to Modify Get IRS 5074 1992: Personalize forms online

Put the appropriate document alteration tools at your disposal. Execute Get IRS 5074 1992 with our dependable solution that includes editing and electronic signature capabilities.

If you wish to finalize and endorse Get IRS 5074 1992 online effortlessly, then our online cloud-based solution is the ideal choice. We provide a comprehensive template-based library of ready-to-use documents you can modify and complete online. Moreover, there's no need to print the form or employ external solutions to make it fillable. All the essential tools will be conveniently accessible once you open the document in the editor.

Let’s explore our online editing tools and their primary functions. The editor features an intuitive interface, so it won't require much time to learn how to use it. We’ll examine three key parts that allow you to:

In addition to the functions mentioned above, you can protect your document with a password, add a watermark, convert the document to the desired format, and much more.

Our editor simplifies completing and authenticating the Get IRS 5074 1992. It allows you to accomplish nearly everything regarding document management. Furthermore, we always guarantee that your document editing experience is secure and compliant with essential regulatory standards. All these factors make using our tool even more enjoyable.

Obtain Get IRS 5074 1992, make the required edits and adjustments, and download it in your preferred file format. Give it a try today!

- Alter and annotate the template

- The upper toolbar includes tools that assist you in emphasizing and obscuring text, without graphics and image elements (lines, arrows, and checkmarks, etc.), adding your signature, initializing, dating the document, and more.

- Arrange your documents

- Utilize the left toolbar if you want to rearrange the document or remove pages.

- Make them shareable

- If you wish to create a fillable template for others and distribute it, you can use the tools on the right to insert various fillable fields, signature and date, text box, etc.

To file Form SS-4 online, visit the IRS website, where you can complete the application for an Employer Identification Number (EIN). The online process is straightforward and offers immediate confirmation. Filing online is efficient, making it simpler to handle your tax identification needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.