Loading

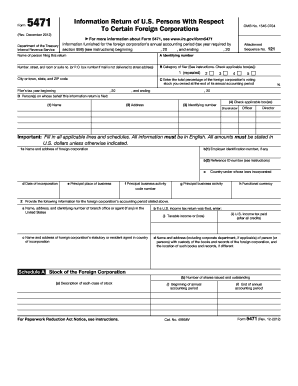

Get Irs 5471 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5471 online

Filing Form 5471 is essential for U.S. persons with interests in certain foreign corporations. This guide provides clear, step-by-step instructions for completing this form online, ensuring you have the necessary information at your fingertips.

Follow the steps to fill out the IRS 5471 online effectively.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Begin by entering the information for the foreign corporation’s annual accounting period, including the start and end dates of the tax year.

- Fill in your details as the person filing the return, including your name, address, and identifying number.

- Indicate the total percentage of the foreign corporation’s voting stock you owned as of the end of the accounting period.

- For each individual or entity on whose behalf the return is filed, provide their name, address, identifying number, and select the applicable role (shareholder, officer, director).

- Complete Schedule A by listing the name and address of the foreign corporation, its employer identification number, date of incorporation, principal place of business, and principal business activity.

- In Schedule B, identify the U.S. shareholders, detailing their names, addresses, identifying numbers, class of stock held, and number of shares at the beginning and end of the accounting period.

- Proceed to Schedule C to provide a detailed income statement for the foreign corporation, reporting all information in the functional currency.

- Fill out Schedule E by entering taxes paid or accrued in foreign currency and converting to U.S. dollars.

- Complete Schedule F, presenting the balance sheet by listing all assets, liabilities, and shareholders’ equity for the beginning and end of the annual accounting period.

- Answer the questions in Schedule G regarding ownership interests in foreign partnerships and trust during the tax year.

- For Schedule H, report current earnings and profits, reflecting any adjustments made according to U.S. accounting standards.

- Finally, review all filled sections to ensure accuracy before saving changes, downloading, printing, or sharing the form as needed.

Complete your IRS 5471 form online today to ensure compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Certain individuals may be exempt from filing IRS form 5471, especially if they do not meet the 10% ownership threshold of a foreign corporation. Additionally, specific categories of foreign corporations or situations, such as taxation under certain treaties, can also provide exemptions. It is beneficial to evaluate your specific circumstances to determine any possible exemptions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.