Loading

Get Irs 6252 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 6252 online

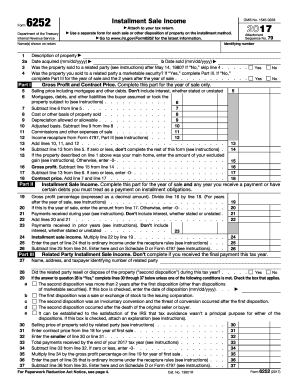

Navigating the IRS 6252 form can be straightforward with the right guidance. This form, used to report income from an installment sale, requires careful attention to detail to ensure compliance with tax regulations.

Follow the steps to complete the IRS 6252 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section 1, provide the identifying information such as the name(s) shown on the return. Ensure all names are spelled correctly and follow the format required by the IRS.

- In Part I, line 5, enter the selling price of the property, including mortgages or debts the buyer assumed. Do not include any interest.

- Move to line 6 and specify the mortgages and debts assumed by the buyer. Only include those that were transferable; do not add new mortgages here.

- For line 7, input the cost or other basis of the property sold. This should reflect your original investment in the property.

- In line 8, detail any depreciation allowed or allowable on the property from the date of purchase until the date of sale.

- Calculate the adjusted basis on line 9 by subtracting line 8 from line 7.

- Line 10 requires reporting any commissions and selling expenses related to the sale of the property.

- On line 11, enter income recapture from Form 4797, if applicable.

- Add lines 10, 11, and 12 for line 12 to find the total expenses related to the sale.

- For line 14, subtract line 13 from line 5; if the result is zero or less, do not complete the rest of the form.

- In Part II, calculate your gross profit percentage on line 19 by dividing line 16 by line 18.

- Enter all received payments during the year on line 22 and combine with any prior year's payments on line 23.

- Complete Part III if selling to a related party. Here, provide additional details about the transaction and any second dispositions.

- After speaking through all required fields, review your entries for accuracy before proceeding.

- Finally, save your changes, download, print, or share the form as necessary.

Complete the IRS 6252 online to ensure your installment sales are reported correctly and efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, real estate transactions typically get reported to the IRS, especially when there are gains or when the sales involve installment payments. IRS form 6252 plays a crucial role in this process, detailing how you report income from these transactions. It’s important to maintain accurate records and comply with reporting requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.