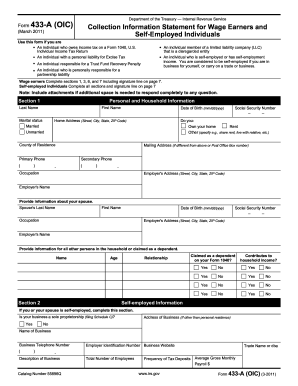

Get Irs 656-b 2011

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Cpa online

How to fill out and sign Dba online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When individuals aren?t associated with document management and legal processes, completing IRS documents will be very exhausting. We fully grasp the significance of correctly completing documents. Our service offers the utility to make the procedure of processing IRS documents as simple as possible. Follow these guidelines to quickly and accurately submit IRS 656-B.

How you can submit the IRS 656-B on-line:

-

Select the button Get Form to open it and start editing.

-

Fill out all necessary lines in your document with our powerful and convenient PDF editor. Turn the Wizard Tool on to finish the procedure even simpler.

-

Make sure about the correctness of added info.

-

Include the date of submitting IRS 656-B. Utilize the Sign Tool to make your personal signature for the document legalization.

-

Finish editing by clicking Done.

-

Send this file to the IRS in the easiest way for you: via electronic mail, making use of digital fax or postal service.

-

You have a possibility to print it on paper if a copy is required and download or save it to the favored cloud storage.

Using our powerful solution will make skilled filling IRS 656-B possible. We will make everything for your comfortable and secure work.

How to edit 1-800-TAX-FORM: customize forms online

Fill out and sign your 1-800-TAX-FORM quickly and error-free. Find and edit, and sign customizable form samples in a comfort of a single tab.

Your document workflow can be much more efficient if everything required for editing and handling the flow is organized in one place. If you are searching for a 1-800-TAX-FORM form sample, this is a place to get it and fill it out without searching for third-party solutions. With this intelligent search engine and editing tool, you won’t need to look any further.

Simply type the name of the 1-800-TAX-FORM or any other form and find the right sample. If the sample seems relevant, you can start editing it right on the spot by clicking Get form. No need to print out or even download it. Hover and click on the interactive fillable fields to insert your details and sign the form in a single editor.

Use more editing instruments to customize your template:

- Check interactive checkboxes in forms by clicking on them. Check other parts of the 1-800-TAX-FORM form text by using the Cross, Check, and Circle instruments

- If you need to insert more textual content into the document, utilize the Text tool or add fillable fields with the respective button. You can even specify the content of each fillable field.

- Add pictures to forms with the Image button. Upload pictures from your device or capture them with your computer camera.

- Add custom visual components to the document. Use Draw, Line, and Arrow instruments to draw on the document.

- Draw over the text in the document if you wish to hide it or stress it. Cover text fragments with theErase and Highlight, or Blackout instrument.

- Add custom components like Initials or Date with the respective instruments. They will be generated automatically.

- Save the form on your computer or convert its format to the one you require.

When equipped with a smart forms catalog and a powerful document editing solution, working with documentation is easier. Find the form look for, fill it out instantly, and sign it on the spot without downloading it. Get your paperwork routine simplified with a solution tailored for editing forms.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing preparer

Watch our video to discover how you can easily complete the 16728N and understand the advantages of using online templates. Simplify your paperwork with excellent web-based tools.

Obligor FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 656-B

- llc

- 55896Q

- 2011

- 55897B

- preparer

- 16728N

- obligor

- 401K

- cpa

- Proprietorship

- COIC

- dba

- 1-800-TAX-FORM

- EIN

- 656-L

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.