Loading

Get Irs 7004 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 7004 online

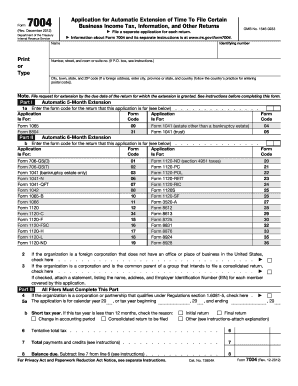

The IRS 7004 form is essential for users seeking an automatic extension of time to file certain business income tax, information, and other returns. This guide provides clear and supportive instructions on how to complete this form online.

Follow the steps to fill out your IRS 7004 online.

- Click the ‘Get Form’ button to retrieve the IRS 7004 form and access it in the editing interface.

- Begin by entering your identifying number in the appropriate field. This is typically your Employer Identification Number (EIN) or Social Security Number (SSN) if you are an individual filer.

- Next, provide the name of your business or your own name if applicable. Ensure that this is printed or typed clearly.

- Fill in your address including the number, street, room or suite number. If you are using a P.O. Box, make sure to follow the instructions provided.

- Complete the city, town, state, and ZIP code fields. For foreign addresses, enter the city, province/state, and country, ensuring to follow the specific postal code conventions of that country.

- In Part I, indicate the form code for the return that you are applying for an extension. Refer to the provided list to select the correct code.

- If you are applying for an automatic 6-month extension, fill in the corresponding form code in Part II as applicable.

- In Part III, confirm whether your organization is a corporation or partnership that qualifies under specific regulations by checking the box.

- Enter the tax year for which you are requesting the extension. This includes filling in the starting and ending dates accurately.

- Provide details for any short tax year if applicable, and check the appropriate reason for the shortened year.

- Calculate and enter the tentative total tax, total payments, and the balance due in lines 6, 7, and 8 respectively.

- Once all information is completed, save the form. You can also download or print it for your records, or share it if necessary.

Take the next step in managing your business's taxes by completing and submitting your IRS 7004 form online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Indeed, you can file IRS extensions electronically using Form 7004. This option allows you to request more time to file your business tax returns seamlessly and efficiently. Using electronic filing generally results in quicker processing times and prompt confirmations. Choosing a service like US Legal Forms can help you navigate this process effortlessly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.