Loading

Get Irs 706 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 706 online

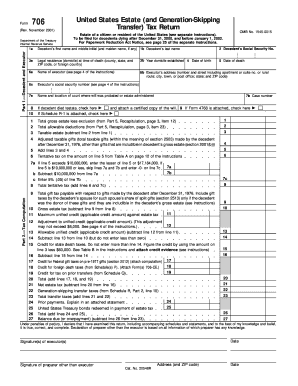

Filling out the IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, can be a complex process. This guide provides a clear, step-by-step approach to assist users in completing the form efficiently and accurately online.

Follow the steps to successfully complete your IRS 706 form online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part 1—Decedent and Executor section. Enter the decedent’s full name, Social Security number, and legal residence at the time of death. Ensure accuracy in entering the domicile details.

- Continue to input the date of death, names of the executor, and their respective information such as address and Social Security number.

- In Part 2—Tax Computation, fill in the total gross estate and allowable deductions. Calculate the taxable estate by subtracting deductions from the gross estate.

- For each applicable deduction and credits, comply with the instructions in the succeeding sections (Part 3 through Part 5), ensuring to input each figure as required.

- Last, review all entered information for completeness and accuracy. Once confirmed, save your changes, and prepare to download, print, or share the completed form as necessary.

Begin your IRS 706 filing process today to ensure compliance and accuracy in your estate management.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

An inheritance tax return is generally prepared by the inheritor or the executor of the estate. The responsibility to file varies depending on state laws, as some locations impose inheritance taxes while others do not. Consulting a tax professional familiar with local regulations can clarify your obligations. U.S. Legal Forms also offers tools to help navigate these requirements efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.