Get Irs 8109-b 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8109-B online

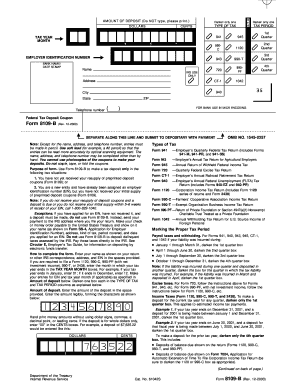

The IRS 8109-B form is essential for making federal tax deposits in specific situations, such as when users have not received preprinted deposit coupons or are new entities. This guide provides clear, step-by-step instructions for completing the form online, ensuring users can navigate the process with confidence.

Follow the steps to fill out the IRS 8109-B form online:

- Click ‘Get Form’ button to obtain the form, which will open it in your designated editor.

- Enter your name, address, and employer identification number (EIN) as shown on IRS correspondence in the respective fields.

- In the 'Tax year month' section, enter the numeric value for the month your tax year concludes (01 for January, 12 for December).

- Fill in the 'Amount of deposit' by writing the dollar amount without using dollar signs or commas. If the amount does not include cents, make sure to indicate '00' in the cents box.

- In the 'Type of tax' section, darken only one box to indicate the type of tax you are depositing (e.g., Form 941 for employer taxes).

- In the 'Tax period' section, darken one box that corresponds to the tax period your deposit applies to, ensuring it aligns with when your tax liability was incurred.

- Provide your daytime telephone number to assist in processing queries related to your deposit.

- Once all fields are correctly filled, you can save changes, download, or print the completed form for submission.

Complete your IRS documents online with confidence today!

Get form

IRS form 1099-B is used to report gains or losses from the sale of securities or certain assets. This form provides crucial information for the IRS to ensure accurate tax reporting on investment income. If you sell stocks, bonds, or mutual funds, you will receive a form 1099-B detailing the transactions. For assistance with understanding your tax responsibilities associated with this form, you can access helpful resources on the US Legal Forms platform.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.