Get Irs 8404 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8404 online

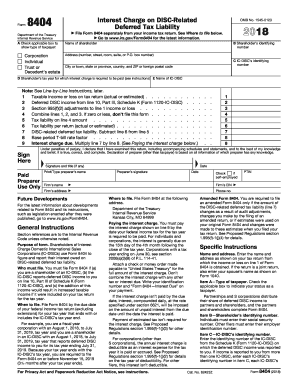

Filling out the IRS Form 8404, which is used to calculate the interest charge on deferred tax liability related to Interest Charge Domestic International Sales Corporations (IC-DISCs), can be an important task for certain taxpayers. This guide provides a straightforward approach to completing the form online, ensuring you understand each component and the process involved.

Follow the steps to accurately complete Form 8404 online.

- Use the 'Get Form' button to access the form and open it in your preferred editor.

- Indicate your taxpayer type by checking the appropriate box. You can select from options such as Corporation, Individual, Trust, or Decedent’s estate.

- Enter the shareholder's identifying number, which for individuals is their Social Security Number (SSN) or Employer Identification Number (EIN) for other entities in the designated field.

- Provide details for the IC-DISC’s identifying number from the Schedule K on which deferred DISC income was reported. If you have more than one IC-DISC, include each identification number.

- Fill in the tax year for which the interest charge is applicable. This should match the tax year displayed on your tax return.

- Complete the necessary calculations: Enter your taxable income or loss from your tax return, deferred DISC income from the reported Schedule K, and any applicable adjustments.

- Calculate the tax liability based on the total of your income, deferred income, and adjustments. Make sure to also figure the tax liability per return.

- Calculate the DISC-related deferred tax liability by subtracting the tax liability from the total tax calculated.

- Determine the interest charge due by applying the base period T-bill rate to the deferred tax liability. Ensure all calculations are accurate.

- Finally, sign and date the form, adding any required preparer information if applicable. Once finished, you can save your changes, download, print, or share the completed form as needed.

Start filling out your IRS Form 8404 online today to ensure compliance and accurate reporting.

Get form

Related links form

Navigating the IRS phone tree can be challenging; however, starting with the main IRS helpline can be beneficial. When prompted, select options related to EIN inquiries or tax questions to reach the right department. If you prefer a more straightforward solution, consider using platforms like USLegalForms that provide guidance for engaging with the IRS's customer service effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.