Get Irs 8404 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8404 online

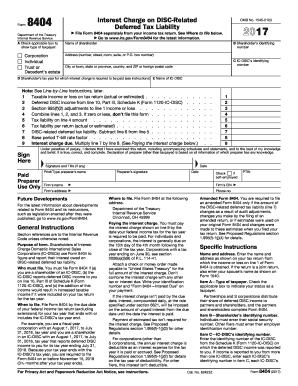

Filling out the IRS Form 8404 is essential for shareholders of Interest Charge Domestic International Sales Corporations (IC-DISCs) to report interest owed on deferred tax liabilities. This guide provides a clear and supportive walkthrough of each section of the form to ensure thorough understanding and compliance.

Follow the steps to successfully complete the IRS 8404 form online.

- Press the 'Get Form' button to retrieve the IRS Form 8404 and launch it in your preferred editor.

- Indicate your type of taxpayer by checking the appropriate box in section A. This may include options such as corporation, individual, trust, or decedent’s estate.

- Enter the shareholder’s identifying number in section B. Individuals should provide their social security number, while other filers must use their employer identification number.

- In section C, enter the identifying number of the IC-DISC as reported in Schedule K (Form 1120-IC-DISC). If you have multiple IC-DISCs, list their identifying numbers separately.

- Input your tax year end date in section D for which the interest charge is applicable.

- Fill out section E by entering the name of the IC-DISC that reported deferred DISC income to you.

- Complete lines 1 through 9 with the information requested. Be sure to gather relevant taxable income or loss, deferred DISC income, adjustments, and calculate the interest charge as instructed.

- Once you finish filling in all required sections, review the form for accuracy before submitting.

- Save your changes, and choose to download, print, or share the completed form as needed.

Complete your IRS 8404 form online today to ensure compliance and timely reporting.

Get form

To obtain a copy of your SS-4 letter online, access your IRS online account if you have registered. You can view and print documents associated with your EIN from there. If you encounter any issues, consider reaching out to the IRS or using US Legal Forms for support. They can provide templates and guidance on how to retrieve this document efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.