Loading

Get Irs 8453-eo 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8453-EO online

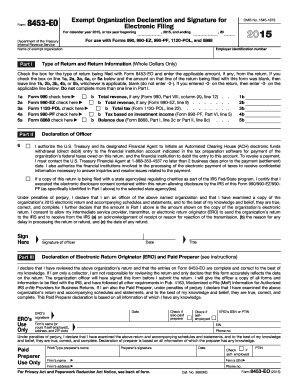

The IRS 8453-EO is an essential form for exempt organizations that need to authenticate their electronic filing of specific tax forms. This guide provides clear instructions for filling out the IRS 8453-EO online, ensuring users understand each section and can complete the form accurately.

Follow the steps to complete the IRS 8453-EO form online.

- Press the ‘Get Form’ button to access the IRS 8453-EO form and open it in your preferred editor.

- In Part I, identify the type of return you are filing. Check the appropriate box for Form 990, 990-EZ, 990-PF, 1120-POL, or 8868, and document the corresponding total revenue, tax, or balance due as instructed.

- Move to Part II, the Declaration of Officer. Here, confirm your authorization for an electronic funds withdrawal if applicable. Fill in the routing number, account number, account type, debit amount, and debit date as needed.

- In Part II, ensure your signature is included as an officer of the organization, certifying the correctness of the information, and include the date of signing.

- Proceed to Part III for the Declaration of Electronic Return Originator and Paid Preparer. If an ERO is involved, they must sign the form here. If using a paid preparer, ensure their section is completed correctly.

- Review all sections for accuracy. Ensure that all required signatures and information are provided before finalizing your form.

- Save your changes to the form, and then create a PDF file of your completed IRS 8453-EO to retain a copy.

- Transmit the completed PDF with your tax return. Make sure to follow the specific instructions for electronic submission.

Complete your IRS 8453-EO form online today to ensure timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

An amended tax return is used to correct errors or changes on a previously filed tax return. It allows you to address mistakes such as misreported income, deductions, or credits. Filing an amended return is a crucial step in ensuring that your tax records accurately reflect your financial situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.