Loading

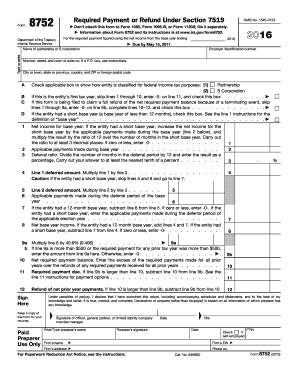

Get Irs 8752 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8752 online

This guide provides a step-by-step approach to completing the IRS Form 8752 online. By following these clear instructions, you can ensure accurate completion of the required payment or refund under Section 7519.

Follow the steps to accurately complete the IRS 8752 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Enter the name of the partnership or S corporation in the designated field. Make sure to type or print clearly.

- Provide the employer identification number (EIN) accurately as it is crucial for identification.

- Fill out the address details including number, street, city, state, and ZIP code or foreign postal code. Ensure the address is complete.

- Select the appropriate classification box for the entity: either partnership or S corporation, and follow any additional instructions regarding first-time filers.

- Calculate and enter the net income for the base year based on the guidelines outlined in the form’s instructions.

- In the applicable payments section, list any payments made during the base year that qualify as ‘applicable payments.’

- Determine the deferral ratio and multiply it with the amounts calculated in the previous steps to find the deferred amounts.

- If applicable, enter the net required payment balance and complete the required payment due section according to the instructions.

- Review all entries for accuracy, and when satisfied, proceed to save your changes, download a copy of the completed form, and prepare for submission.

Encourage users to complete their IRS 8752 online to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To file a business name change with the IRS, you typically need to notify them using IRS Form 8822-B. This form should be mailed to the appropriate address based on your business's location. Additionally, ensure you update any related state or local registrations to reflect the name change accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.