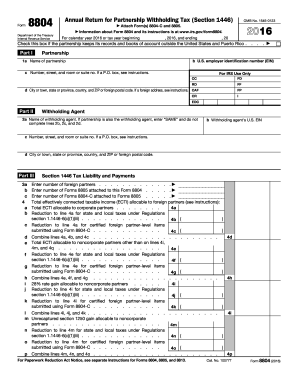

Get Irs 8804 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8804 online

How to fill out and sign IRS 8804 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If individuals aren't linked to document management and legal procedures, submitting IRS documentation can be surprisingly challenging.

We understand the importance of accurately completing documents.

Utilizing our service will make skilled completion of IRS 8804 a reality, ensuring your work is comfortable and straightforward.

- Click the button Get Form to access it and begin editing.

- Complete all mandatory fields in your document with our sophisticated PDF editor. Activate the Wizard Tool to simplify the process significantly.

- Verify the accuracy of the information provided.

- Include the date of completing IRS 8804. Utilize the Sign Tool to create your unique signature for document validation.

- Finalize the changes by clicking Done.

- Transmit this document directly to the IRS in the most convenient way for you: via email, through virtual fax, or by postal service.

- You can print it on paper if a physical copy is required and download or save it to your chosen cloud storage.

How to Modify Get IRS 8804 2016: Personalize Forms Online

Utilize the functionality of the versatile online editor while filling out your Get IRS 8804 2016. Take advantage of the assortment of tools to swiftly complete the fields and supply the necessary information promptly.

Preparing documentation is time-consuming and expensive unless you possess pre-prepared fillable templates to complete them electronically. The simplest way to manage the Get IRS 8804 2016 is by using our expert and multifunctional online editing tools. We provide you with all essential tools for rapid form completion and enable you to adjust any aspect of your forms to fit your requirements. Additionally, you can add comments on the modifications and leave messages for other involved parties.

Here’s what you can accomplish with your Get IRS 8804 2016 in our editor:

Managing Get IRS 8804 2016 in our robust online editor is the fastest and most efficient approach to organize, submit, and share your documentation as required from any location. The tool operates from the cloud, enabling you to access it from any site on any internet-capable device. All forms you create or fill out are securely stored in the cloud, so you can always retrieve them when necessary and be confident of their safety. Cease wasting time on manual document preparation and eliminate paper; handle everything online with minimal effort.

- Fill in the blank sections using Text, Cross, Check, Initials, Date, and Signature features.

- Emphasize important details with a preferred color or underline them.

- Obscure sensitive information using the Blackout tool or simply delete it.

- Insert images to illustrate your Get IRS 8804 2016.

- Substitute the original text with your preferred wording.

- Add comments or sticky notes to notify others about the modifications.

- Include additional fillable fields and assign them to specific individuals.

- Secure the template with watermarks, timestamps, and Bates numbers.

- Distribute the document in various manners and save it to your device or cloud in multiple formats once you finish editing.

Failing to file Form 8804 can result in significant penalties, including fines based on the amount of tax owed. The IRS can impose a failure-to-file penalty, which can accumulate daily until you comply. Therefore, it is vital to meet your filing deadlines and ensure that your obligations are met to avoid these penalties.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.