Loading

Get Irs 8804 - Schedule A 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8804 - Schedule A online

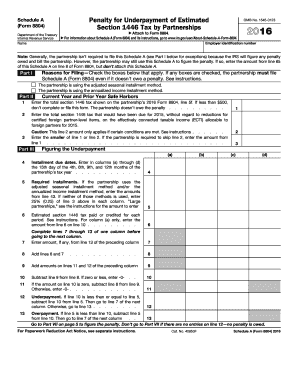

Filling out the IRS 8804 - Schedule A may seem complex, but with a clear understanding of each section, you can successfully complete the form online. This guide provides detailed, step-by-step instructions to assist you in navigating the form's components efficiently.

Follow the steps to complete the IRS 8804 - Schedule A online

- Press the ‘Get Form’ button to download the form and open it in your preferred online editor.

- Begin by entering the name and employer identification number of the partnership at the top of the form.

- In Part I, check the relevant boxes that apply to your situation. This determines whether you are required to file Schedule A, even if no penalty is owed.

- Move to Part II. For line 1, input the total section 1446 tax shown on the partnership’s 2016 Form 8804, line 5f. If this amount is less than $500, you do not need to complete the form.

- Proceed to Part III to indicate installment due dates. In the corresponding columns, note the dates of the 15th of the 4th, 6th, 9th, and 12th months of the partnership’s tax year.

- Enter the required installments for each method used by the partnership on line 4. If neither method applies, enter 25% of line 3 in each column.

- For line 5, record the estimated section 1446 tax that has been paid or credited for each period as outlined in the instructions.

- Complete the calculations in columns (a) through (d) as instructed, ensuring you fully finish one column before moving to the next.

- Continue through Parts IV and V, following the instructions closely to determine whether to use the adjusted seasonal installment method or the annualized income installment method.

- Finally, review your entries and ensure accuracy. Save your changes, then download, print, or share the completed form as necessary.

Start filling out your IRS 8804 - Schedule A online today to ensure timely and accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, there is an extension available for IRS 8804 - Schedule A, but you must submit a separate extension request using Form 7004. This extension allows additional time to file, helping you avoid potential penalties. Understanding how to manage your filing requirements effectively can save you time and stress.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.