Loading

Get Irs 8812 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8812 online

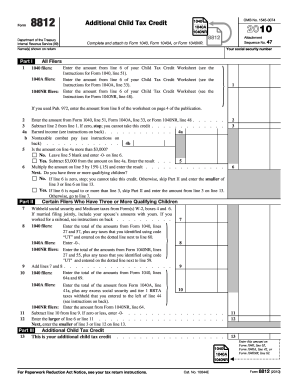

Filling out the IRS Form 8812, also known as the Additional Child Tax Credit, is essential for individuals looking to determine eligibility for this credit. This guide provides clear and concise instructions to aid users in completing the form accurately and efficiently online.

Follow the steps to complete Form 8812 effectively.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name(s) as shown on your tax return at the top of the form. Ensure that the names match the Social Security records to avoid delays.

- Input your Social Security number in the designated field to identify your tax return and tie your credit to the correct individual.

- Move to Part I. Enter the amount from line 6 of your Child Tax Credit Worksheet applicable to your form type (Form 1040, 1040A, or 1040NR). Reference the respective instructions provided on those forms for accurate values.

- In line 2, subtract the amount entered in line 1 from the amount in line 2. If the outcome is zero, you are not eligible for this credit.

- Proceed to line 4a, where you will enter your total earned income based on relevant instructions. If applicable, also enter nontaxable combat pay in line 4b.

- Answer the question regarding whether the amount on line 4a is greater than $3,000. If 'Yes', complete line 5 by subtracting $3,000 from line 4a. If 'No', leave line 5 blank.

- Multiply the amount in line 5 by 15% and enter the result in line 6. This step calculates the credit based on your earnings.

- Determine if you have three or more qualifying children. Follow the instructions accordingly based on the answer and complete the subsequent lines as guided.

- In Part II, include withheld Social Security and Medicare taxes from Form W-2. Be sure to sum your spouse's amounts if filing jointly.

- Complete any remaining lines, ensuring all amounts are correct and correspond with the documentation provided.

- Review the completed form for accuracy, save any changes made, and select the options to download, print, or share the document as needed.

Start completing your IRS Form 8812 online today to ensure you maximize your tax credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If you are not receiving your full child tax credit, it could be due to income limitations, a lack of qualifying dependents, or filing errors. Review your submitted tax return and ensure that you completed IRS Form 8812 correctly. If you still have questions, consider using US Legal Forms for additional resources and guidance to optimize your tax benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.