Loading

Get Irs 8815 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8815 online

Filling out the IRS 8815 form can seem daunting, but with this comprehensive guide, you will understand each section and field efficiently. This guide provides clear instructions tailored to your needs, ensuring you can complete the form online with confidence.

Follow the steps to effectively complete the IRS 8815 online.

- Click ‘Get Form’ button to download the form and open it in your preferred editing tool.

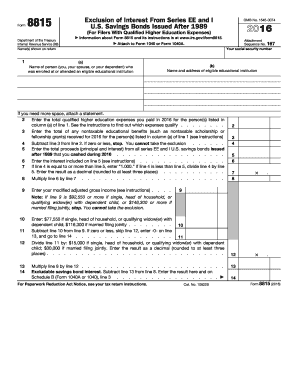

- In line 1, enter the name of the person who was enrolled at or attended an eligible educational institution. This could be you, your spouse, or a dependent.

- On line 2, input the total qualified higher education expenses you paid in 2016 for the person listed in line 1. Make sure you verify which expenses qualify according to the provided instructions.

- Line 3 requests the total of any nontaxable educational benefits received for the person in line 1. Be sure to exclude any benefits that do not meet the criteria specified in the instructions.

- Line 5 requires you to subtract the value entered in line 3 from line 2. If the result is zero or less, you cannot take the exclusion.

- On line 6, enter the total proceeds from all series EE and I U.S. savings bonds that you cashed during 2016. This includes both principal and interest.

- For line 9, enter your modified adjusted gross income. Follow the calculations outlined in the instructions to arrive at this figure accurately.

- Once all entries are complete, review your form for accuracy.

Complete your IRS forms online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To avoid taxes when cashing in savings bonds, you must adhere to the guidelines of IRS 8815. Primarily, the interest earned on savings bonds is not taxable if used for qualified education expenses, provided you meet the income criteria. Consider utilizing resources on platforms like US Legal Forms to ensure you navigate this process successfully and securely.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.