Loading

Get Irs 8822 2015-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8822 online

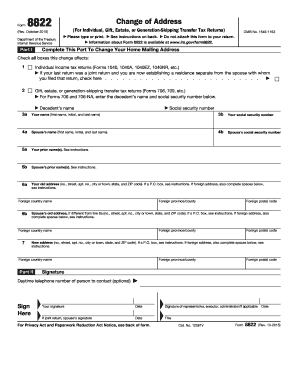

This guide provides clear and supportive instructions for filling out the IRS 8822 form, which is used to notify the Internal Revenue Service of a change in home mailing address. Follow the steps to ensure your form is completed accurately and submitted without delay.

Follow the steps to successfully complete the IRS 8822 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, indicate all tax returns that this change affects by checking the appropriate boxes for individual income tax returns and gift, estate, or generation-skipping transfer tax returns.

- Provide your full name, including first name, initial, and last name in line 3a, followed by your social security number in line 3b.

- If applicable, enter your spouse's name in line 4a and their social security number in line 4b.

- Complete line 5 with any prior name(s) you or your spouse have used.

- In lines 6a and 6b, enter your old mailing address, including street address, city or town, state, and ZIP code. If you are using a P.O. box or have a foreign address, follow the additional instructions provided on the form.

- If your spouse has a different old address, fill it in lines 6b and include the necessary details as you did for your address.

- In the new address section, provide your new mailing address in the designated field.

- In Part II, sign and date the form. If you filed a joint return, ensure that your spouse also signs the form.

- If applicable, include the signature and date of any representative, executor, or administrator.

- After completing the form, save your changes and choose to download, print, or share the document according to your needs.

Complete your IRS 8822 form online today to update your address efficiently.

Related links form

After completing Form 8822, send it to the address listed in the instructions that accompany the form. Make sure to mail it via a trackable service for confirmation of delivery. If you need assistance with this process, turning to US Legal Forms can offer clarity and support, helping you manage your submission efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.