Get Irs 8823 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8823 online

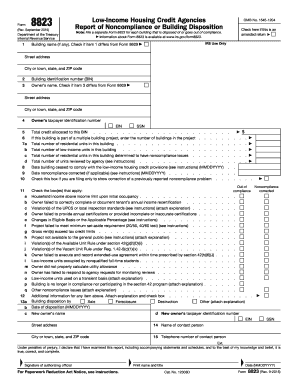

This guide provides a clear and supportive approach to filling out the IRS Form 8823, which is essential for reporting noncompliance or building disposition regarding low-income housing credits. With detailed instructions, you will navigate each section of the form with confidence.

Follow the steps to complete the IRS 8823 effectively.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- In the first section, enter the building name and address. Check the box if this information differs from what is listed on Form 8609.

- Provide the building identification number (BIN) assigned by the housing credit agency.

- Input the owner’s name and address, making note if this differs from Form 8609.

- Enter the owner's taxpayer identification number (TIN) as required.

- Detail the total credit allocated to this building identification number.

- If applicable, specify the number of buildings in a multiple building project and the total number of residential and low-income units.

- Indicate the total number of residential units identified to have noncompliance issues and the total units reviewed by the agency.

- Record the date the building ceased to comply with low-income housing credit provisions.

- If applicable, enter the date on which noncompliance was corrected.

- Check the appropriate box(es) that describe the nature of noncompliance encountered.

- Provide additional information regarding any noncompliance issues, attaching explanations where necessary.

- If the building has been disposed of, indicate the date of disposition and method (e.g., sale, foreclosure, destruction).

- Fill in the new owner's details if applicable, including taxpayer identification number.

- Sign and date the form, confirming the accuracy of the report under penalties of perjury.

- Once completed, save your changes. You may choose to download, print, or share the form as needed.

Complete the IRS 8823 online to ensure compliance and proper reporting of noncompliance issues.

Get form

Related links form

The IRS verifies head of household status by examining the information you provide on your tax return as well as matching it against records from previous years. They may check for documentation confirming marital status, household income, and the presence of qualifying individuals. It's important to ensure all submitted information is accurate to reduce the likelihood of audits.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.