Loading

Get Irs 8825 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8825 online

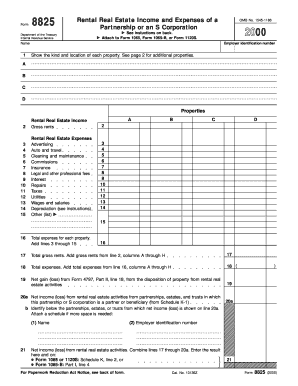

Filling out the IRS 8825 form accurately is essential for partnerships and S corporations reporting rental real estate income and expenses. This guide provides user-friendly steps to help you navigate the process effectively.

Follow the steps to complete the IRS 8825 online successfully.

- Click 'Get Form' button to access the IRS 8825 form and open it in the editor.

- Begin by entering the name of the partnership or S corporation and the employer identification number at the top of the form.

- In the properties section, specify the kind and location of each rental property. Fill out columns A to H for each property listed.

- Provide the gross rental income for each property under the 'Rental Real Estate Income' section. This is typically the total rents received.

- List all rental real estate expenses incurred for each property in the 'Rental Real Estate Expenses' section. This includes advertising, cleaning and maintenance, insurance, repairs, and other categories provided.

- Calculate the total expenses for each property by adding lines 3 through 15 for that property, and enter the result in line 16.

- On line 17, calculate the total gross rents by adding the gross rents reported from line 2, columns A through H.

- For line 18, add up the total expenses stated on line 16, columns A through H.

- Input any net gain or loss from the disposition of real estate properties as instructed on line 19.

- If applicable, record the net income or loss from rental real estate activities flowing from partnerships or trusts as guided on line 20.

- Finally, combine the totals from lines 17 through 20a and enter this result at the bottom of the form, ensuring to attach any necessary additional schedules or statements.

- Once all sections are completed, users can save changes, download, print, or share the form as needed.

Take the next step and complete your IRS 8825 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain IRS form 4506 T, you can visit the IRS website and download it directly. This form allows you to request a transcript of your tax return information, essential for verifying income. Alternatively, you can request it via mail, but downloading is quicker. Keep in mind that you’ll need to include details from your IRS form 8825, if applicable.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.