Loading

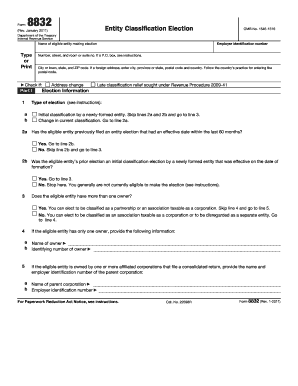

Get Irs 8832 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8832 online

Filling out the IRS Form 8832, also known as the entity classification election, is an important step for eligible entities to determine their federal tax classification. This guide provides clear, step-by-step instructions to help users accurately complete the form online.

Follow the steps to fill out the IRS 8832 accurately and efficiently.

- Press the ‘Get Form’ button to retrieve the form and open it in the editing environment.

- Begin by entering the employer identification number (EIN) of the eligible entity in the designated field. Ensure that you use your existing EIN if applicable, as do not include ‘Applied For’.

- Fill in the name of the eligible entity making the election. This should be the legal name registered with the IRS.

- Provide the complete address of the entity, including number, street, and city. If using a P.O. Box, indicate that in the address section.

- Check the box if this form is to notify about an address change since the last filing. If not applicable, skip this step.

- Select the type of election being made. Indicate whether this is an initial classification or a change in current classification by checking the appropriate box.

- If applicable, indicate whether the entity is seeking late-classification relief under Revenue Procedure 2009-41 by checking the respective box.

- Answer whether the eligible entity has more than one owner. If yes, you will select between classifications available for multiple owner entities.

- If there is only one owner, provide the owner's name and identifying number in the respective fields.

- If applicable, provide the information for the parent corporation if the eligible entity is owned by one or more affiliated corporations.

- Select the type of entity being classified from the provided options. This includes options for both domestic and foreign entities.

- Enter the effective date for the election in the appropriate field, ensuring it complies with the 75-day and 12-month regulations.

- Designate a contact person for any follow-up the IRS may require, and include their phone number.

- Complete the consent statement by having all necessary parties sign and date the form, affirming the information is accurate.

- If you are requesting late-election relief, provide a brief explanation of the reason for the delay in filing, then sign and date the form.

- Once all information is complete, save your changes. You can then download, print, or share the filled form as needed.

Complete your IRS Form 8832 online today and ensure your entity is classified appropriately for tax purposes.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The organization should submit Form 2553: If the tax year is only going to last less than 2 months and 15 days then Form 2553 must be filed in the 2nd month on the 15th day of the tax year. Form 2553 can be filed at any time before the year in which the election is to take effect.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.