Get Irs 8854 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8854 online

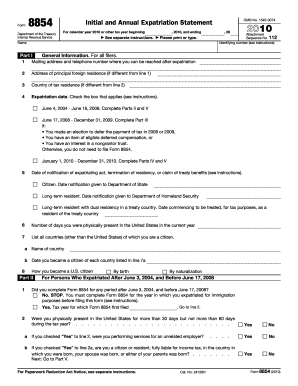

This guide provides a comprehensive overview to assist users in accurately completing the IRS Form 8854 online. The IRS 8854 is the initial and annual expatriation statement required for individuals who have expatriated from the United States.

Follow the steps to fill out the IRS Form 8854 online.

- Click ‘Get Form’ button to obtain the form and access it for completion.

- Complete your personal information in Part I, including your name, mailing address, and contact details where you can be reached post-expatriation.

- Provide information about your foreign residence, tax residency, and the date of your expatriation. Ensure to check the appropriate box based on the date range applicable to you.

- Indicate the number of days you were physically present in the United States during the current year and list all countries where you hold citizenship.

- Move to Part II if your expatriation was after June 3, 2004, and before June 17, 2008. Answer the questions regarding your physical presence in the United States and any prior forms filed.

- Proceed to Part III if your expatriation was after June 16, 2008, and before January 1, 2010. Fill out sections concerning any deferred tax payments or distributions.

- For expatriation during 2010, complete Part IV by entering your U.S. tax liabilities for the five tax years before expatriation and provide your net worth at the time.

- Continue to Part V, where you will report your balance sheet and income statement, ensuring to itemize assets, liabilities, and income sources accurately.

- Review all completed sections for accuracy and completeness. You can then save changes, download, print, or share the IRS Form 8854 as needed.

Ensure your expatriation is properly documented by completing IRS Form 8854 online.

Get form

Related links form

Yes, you can file your return electronically, including forms that can be e-filed, making the process swift and efficient. However, be aware that certain forms like IRS Form 8854 must be filed on paper due to IRS guidelines. Ensure that your tax software or platform supports electronic filing for your specific forms to avoid compliance issues. Staying up-to-date with requirements ensures you can file your taxes smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.