Loading

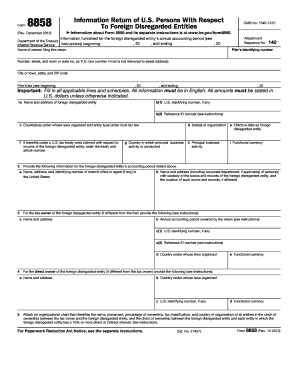

Get Irs 8858 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8858 online

This guide provides clear and comprehensive instructions for filling out the IRS Form 8858 online. Designed for individuals with various levels of familiarity, it aims to make the process straightforward and accessible.

Follow the steps to complete the IRS Form 8858 online.

- Use the ‘Get Form’ button to obtain the form and open it for editing.

- Fill in the filer’s identifying number and name in the respective fields. Provide your complete address including street number, city, state, and ZIP code.

- Specify the tax year for which you are filing, indicating both the beginning and ending dates.

- Enter the name and address of the foreign disregarded entity in section 1a, and ensure to provide its U.S. identifying number if available.

- Complete sections regarding the country of organization, effective date, and any claims under U.S. tax treaties in fields 1c through 1f.

- For the accounting period, provide necessary details including the name, address, and identifying number of any U.S. branch office or representative.

- If applicable, enter information regarding the tax owner of the foreign disregarded entity, covering sections 3 and 4.

- Attach the required organizational chart if needed, detailing ownership and classification information as directed.

- Complete Schedule C with income statements including gross receipts and deductions, ensuring amounts are reported in functional currency and U.S. dollars.

- Proceed to fill out Schedule F for the balance sheet, reporting totals for assets, liabilities, and owner’s equity.

- Answer questions in Schedule G based on additional information required regarding ownership interests or transactions.

- Review all entries for accuracy, then save changes. You may also download, print, or share the completed form as needed.

Start completing your IRS Form 8858 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To report a tax crime to the IRS, you can use Form 3949-A, which allows you to report suspected tax fraud or evasion. Provide detailed information about the individual or entity involved and any pertinent documentation. Reporting timely helps the IRS address tax violations effectively, contributing to overall tax compliance, including issues related to form IRS 8858.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.