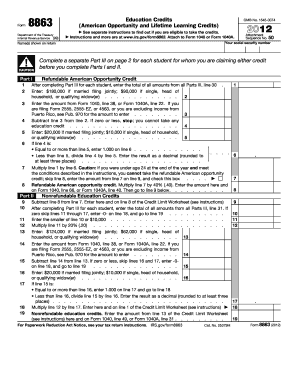

Get Irs 8863 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8863 online

How to fill out and sign IRS 8863 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If you aren’t linked to document management and legal procedures, completing IRS forms will be quite cumbersome. We fully understand the significance of accurately filling out forms. Our platform offers a way to streamline the process of handling IRS documents as smoothly as possible. Follow these instructions to accurately and swiftly fill out IRS 8863.

How you can submit the IRS 8863 online:

Utilizing our ultimate solution can certainly facilitate professional completion of IRS 8863. Make everything for your comfortable and secure work.

Select the button Get Form to access it and start editing.

Complete all required fields in your document using our professional PDF editor. Activate the Wizard Tool to make the process even easier.

Verify the accuracy of the entered information.

Include the date of completing IRS 8863. Use the Sign Tool to create a personal signature for document authentication.

Finish editing by clicking Done.

Send this document directly to the IRS in the most convenient manner for you: via email, using online fax, or by mail.

You also have the option to print it on paper if a copy is needed and download or save it to your preferred cloud storage.

How to Modify Get IRS 8863 2012: Personalize Forms Online

Authorize and distribute Get IRS 8863 2012 along with any additional business and personal files online, eliminating unnecessary time and resource expenditure on printing and mailing. Maximize the benefits of our online document editor featuring a built-in compliant electronic signature tool.

Signing and submitting Get IRS 8863 2012 templates digitally is faster and more effective than handling them in hard copy. Nonetheless, it necessitates the use of online solutions ensuring a high degree of data security and providing a certified instrument for generating electronic signatures. Our robust online editor is precisely what you need to finalize your Get IRS 8863 2012 and other personal, business, or tax forms accurately and suitably in compliance with all regulations. It comprises all the necessary tools to conveniently and rapidly complete, alter, and endorse documents online, and add Signature fields for additional participants, designating who and where should sign.

Completing and signing Get IRS 8863 2012 online is accomplished in just a few straightforward steps:

Distribute your document to others using one of the available methods. By signing Get IRS 8863 2012 with our vigorous online solution, you can always be assured it is legally binding and admissible in court. Prepare and submit documents in the most efficient manner possible!

- Access the chosen file for further editing.

- Utilize the top panel to insert Text, Initials, Image, Check, and Cross notations to your document.

- Highlight the crucial information and obscure or eliminate any sensitive details if required.

- Click on the Sign tool above and determine your preferred method to eSign your document.

- Draw your signature, type it, upload its image, or choose an alternative method that fits your preference.

- Navigate to the Edit Fillable Fields panel and place Signature fields for other individuals.

- Click on Add Signer and enter your recipient’s email to delegate this field to them.

- Verify that all provided information is complete and accurate before clicking Done.

If your school does not provide you with a 1098-T form, you can still claim the benefits associated with the IRS Form 8863. You may need to gather alternative documentation to support your qualifying educational expenses. It's crucial to keep records of payments made for tuition and related fees, as this documentation will help you substantiate your claim for the American Opportunity Credit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.