Loading

Get Irs 8898 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8898 online

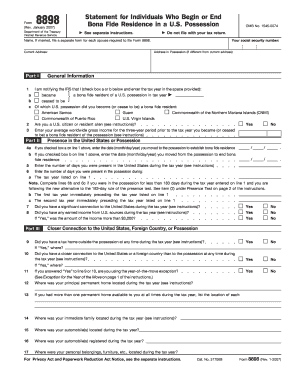

Filling out the IRS Form 8898 is an important step for people who begin or end bona fide residence in a U.S. possession. This guide provides comprehensive instructions to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete the IRS 8898 form.

- Click the ‘Get Form’ button to obtain the form and access it in the online editor.

- Begin by entering your name in the designated field. If you are married and both you and your partner are required to file, a separate form must be filed for each spouse.

- Provide your current address, ensuring it is correct as this is where IRS will send any correspondence.

- Enter your social security number in the specified area; this information is crucial for identification purposes.

- If your address in the possession differs from your current address, fill in that information in the next field.

- In Part I, indicate whether you became or ceased being a bona fide resident of a U.S. possession by checking the appropriate box (a or b) and entering the relevant tax year.

- Specify the U.S. possession related to your status change by selecting from options such as American Samoa, Guam, Puerto Rico, or others.

- Indicate if you are a U.S. citizen or resident alien by answering the Yes or No question appropriately.

- Provide your average worldwide gross income for the three-year period prior to the tax year of your status change.

- In Part II, input the date you moved to or from the possession to establish or cease bona fide residence.

- Enter the total number of days you were present in the United States during the tax year, followed by the number of days in the possession.

- Respond to questions about your significant connection to the United States and any earned income from U.S. sources during the tax year.

- In Part III, fill out questions regarding your closer connection to the U.S., foreign countries, or your tax home.

- Provide information regarding your immediate family, personal belongings, and significant banking activities during the tax year.

- Finish filling out the remaining fields as instructed, ensuring all responses are accurate and complete.

- Once you have reviewed all entries for accuracy, save your changes. You can choose to download, print, or share the form.

Complete your IRS 8898 form online today for a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You should file IRS form 8822 when you change your permanent address. It's essential to keep your address updated to ensure that you receive important IRS correspondence. Filing this form promptly helps you avoid misunderstandings with tax documents and communications from the IRS.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.