Loading

Get Irs 8917 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8917 online

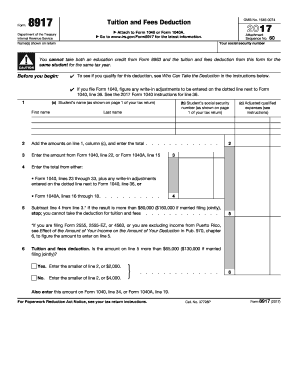

This guide aims to assist users in accurately completing IRS Form 8917, which is used for claiming the tuition and fees deduction. By following these steps, you can ensure that you successfully navigate the form online while understanding each component involved.

Follow the steps to accurately complete Form 8917.

- Click 'Get Form' button to access the form and open it in the editor.

- In line 1, enter the student's name and social security number. This should match the information provided on page 1 of your tax return.

- For line 2, add the amounts from line 1, column (c), which reflect the adjusted qualified education expenses for each student.

- On line 3, input the amount from Form 1040, line 22, or Form 1040A, line 15, determining your adjusted income.

- Complete line 4 by entering the total from either Form 1040, lines 23 through 33, plus any adjustments from Form 1040, line 36.

- Subtract line 4 from line 3. If this amount exceeds $80,000 ($160,000 for married filing jointly), you are not eligible for the deduction.

- For line 6, assess if the figure from line 5 is greater than $65,000 ($130,000 for married filing jointly). If yes, enter the smaller of line 2 or $2,000. If no, enter the smaller of line 2 or $4,000.

- Finally, record the amount from line 6 on Form 1040, line 34, or Form 1040A, line 19. Ensure all entries are correct before saving.

- Once you have completed the form, you can save your changes, download, print, or share the document as needed.

Don't hesitate to complete your IRS forms online to ensure accurate tax filing and deductions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To receive the full $2,500 American Opportunity Credit, ensure you meet all eligibility requirements, including enrollment status, income limits, and having qualified education expenses. It's also important to accurately complete and submit the IRS 8863 tax form and use IRS 8917 to report any qualifying tuition. Staying organized will help maximize your claims.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.