Get Irs 8965 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8965 online

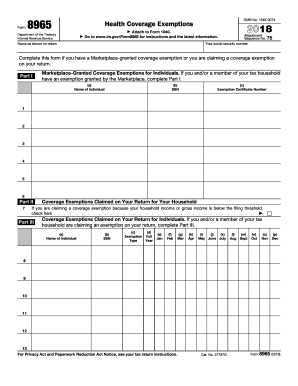

Filling out the IRS 8965 form is an important step for individuals who have received a coverage exemption from the Marketplace or are claiming a coverage exemption on their tax return. This guide provides clear instructions to help you navigate the form efficiently.

Follow the steps to complete your IRS 8965 form online

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your name as it appears on your tax return in the designated field.

- Input your Social Security Number (SSN) in the corresponding section.

- If you have a Marketplace-granted coverage exemption for yourself or a member of your household, fill out Part I. Enter the name, SSN, and Exemption Certificate Number for each individual receiving an exemption.

- In Part II, check the provided box if you are claiming a coverage exemption based on the household income being below the filing threshold.

- Complete Part III for individuals claiming an exemption on the return. For each person, enter their name, SSN, exemption type, and indicate for which months they are eligible by marking the appropriate boxes.

- Review all entered information for accuracy to ensure there are no errors.

- Once you have completed the form, save your changes, and you can choose to download, print, or share the form as necessary.

Take the next step in your financial management by completing your IRS 8965 form online today.

The affordability threshold for health plans is the percentage of your income that you should not exceed for your insurance policy’s premiums. Currently, this percentage stands at 9.83% for the applicable tax year. If your insurance exceeds this threshold, you may qualify for an exemption while filing Form 8965. Platforms like uslegalforms can assist you in determining your eligibility and filing effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.