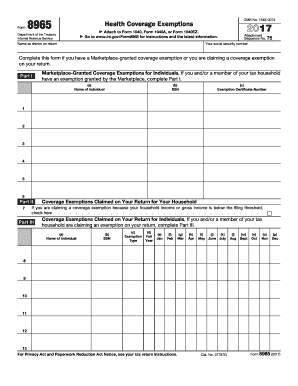

Get Irs 8965 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8965 online

How to fill out and sign IRS 8965 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When people aren’t linked to document management and legal procedures, submitting IRS paperwork can be surprisingly exhausting.

We recognize the importance of accurately completing forms.

Using our service definitely facilitates the professional completion of IRS 8965. We will ensure everything for your ease and convenience.

- Our service provides the solution to simplify the process of managing IRS documents.

- Click the button Get Form to access it and begin editing.

- Fill out all required fields in the document using our efficient PDF editor.

- Activate the Wizard Tool to make the procedure even easier.

- Verify the accuracy of the information provided.

- Include the date of filing IRS 8965.

- Utilize the Sign Tool to create your unique signature for document validation.

- Finish editing by clicking Done.

- Submit this document directly to the IRS in the most convenient manner for you: via email, digital fax, or postal service.

- You can print it on paper if a copy is necessary and download or save it to your preferred cloud storage.

How to Modify Get IRS 8965 2014: Tailor Forms Online

Completing documents is more convenient with intelligent online resources. Eliminate paperwork with easily accessible Get IRS 8965 2014 templates that you can modify online and print.

Creating documents and paperwork should be easier, whether it's a routine aspect of one's job or occasional tasks. When someone needs to submit a Get IRS 8965 2014, understanding regulations and guidelines on how to accurately fill out a form and what it needs to contain can consume a lot of time and effort. However, if you discover the right Get IRS 8965 2014 template, completing a document will become less of a hassle with a savvy editor available.

Explore a broader range of features you can incorporate into your document workflow. No requirement to print, fill out, and annotate forms by hand. With an intelligent editing platform, all crucial document processing features will always be readily available. If you wish to enhance your work process with Get IRS 8965 2014 forms, locate the template in the catalog, click on it, and experience a simpler way to complete it.

Minimize the likelihood of mistakes using the Initials and Date tools. It's also feasible to introduce custom graphic components to the form. Use the Arrow, Line, and Draw tools to personalize the document. The more tools you understand, the simpler it is to work with Get IRS 8965 2014. Test the solution that provides everything necessary to locate and modify forms in one browser tab and eliminate manual paperwork.

- If you want to insert text at any section of the form or add a text field, utilize the Text and Text field tools and expand the text in the form as desired.

- Employ the Highlight tool to emphasize the significant areas of the form.

- If you aim to conceal or delete certain parts of the text, apply the Blackout or Erase tools.

- Personalize the form by integrating default graphic elements into it. Use the Circle, Check, and Cross tools to incorporate these elements into the forms, if feasible.

- If you require extra annotations, utilize the Sticky note tool and place as many notes on the forms page as necessary.

- Should the form necessitate your initials or date, the editor features tools for those as well.

Related links form

To fill out a withholding exemption form, start with accurate personal information, including your name and Social Security number. Then, follow the IRS instructions closely for calculating your withholding exemptions. Be prepared to reference details about your insurance coverage, especially concerning IRS 8965, if applicable. Platforms like US Legal Forms can provide templates that simplify this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.