Loading

Get Ca Ftb 590 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 590 online

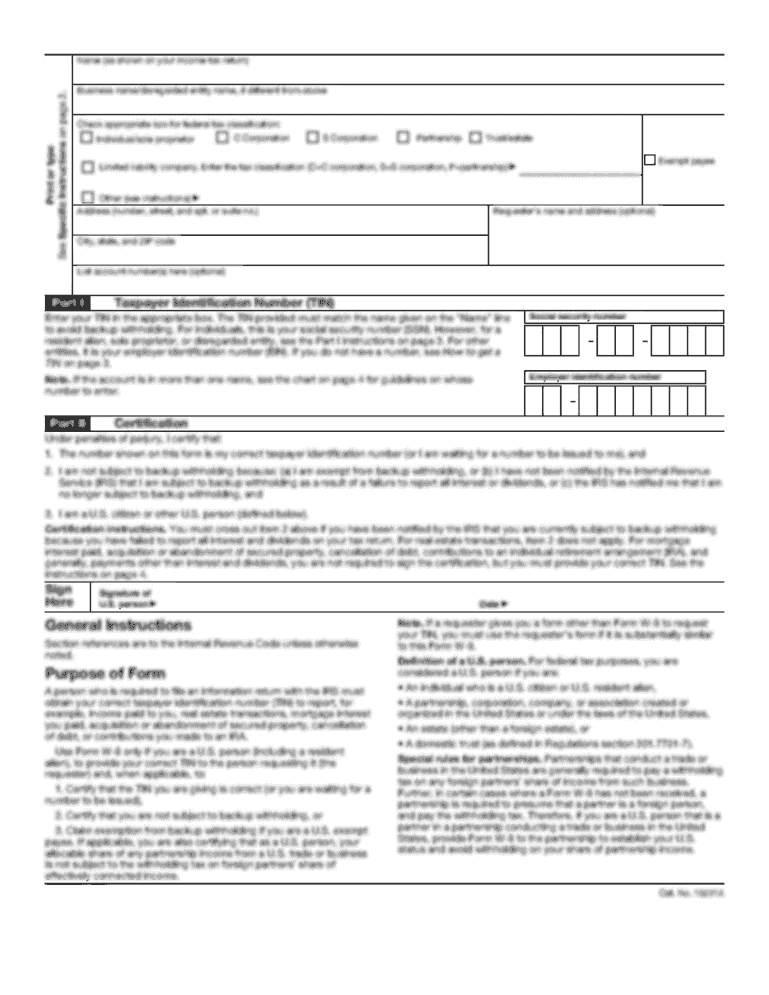

Filling out the CA FTB 590 form online can seem daunting, but with this comprehensive guide, you will easily navigate each section of the form. This guide aims to provide clear, step-by-step instructions for users of all experience levels.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to obtain the form, enabling you to open it in your preferred online editor.

- Enter the taxable year at the top of the form. For example, if you are filling the form for the year 2020, ensure that is clearly indicated.

- Fill in the withholding agent information by providing the name of the withholding agent as well as the payee's name.

- Complete the address section. Include your apartment or suite number, room, PO box, or PMB number, followed by the city, state, and ZIP code. If you have a foreign address, be sure to review the instructions.

- Identify the exemption reason by checking only one of the boxes provided. Make sure to read each option carefully to select the one that accurately represents your situation.

- Complete the certificate of payee section by typing or printing your name and title, followed by your signature and date. This declaration attests to the accuracy of the information provided.

- Review all your information to ensure accuracy. Once you have verified that everything is correct, you can either save your changes, download, print, or share the completed form.

Start completing the CA FTB 590 online today to ensure proper tax withholding compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The most widely recognized standard is 30 days, meaning if you spent more than 30 days during the year working in a state you would be obligated to file a tax return for that state. Spend less than 30 days on a truly temporary basis and no tax return is due.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.