Loading

Get Ct Drs Ct-706 Nt 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-706 NT online

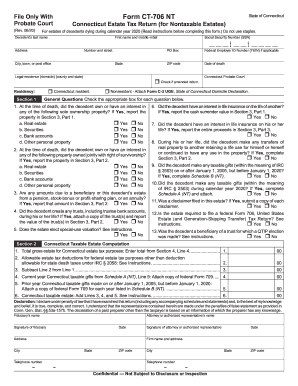

Filling out the CT DRS CT-706 NT form is a crucial step in reporting a Connecticut estate tax for nontaxable estates. This guide will walk you through each section and field of the form, ensuring clarity and ease as you complete it online.

Follow the steps to fill out the form with confidence.

- Press the ‘Get Form’ button to access the CT DRS CT-706 NT form and open it for editing.

- Begin by entering the decedent’s full name, address, and Social Security Number in the designated fields. Ensure all information is accurate as this forms the foundation of the document.

- In the residency section, indicate whether the decedent was a Connecticut resident or a nonresident by checking the appropriate box. If nonresident, be prepared to attach Form C-3, UGE.

- Proceed to the general questions section. For each question, select ‘Yes’ or ‘No’ based on the decedent's ownership of property and any other relevant interests, as this information impacts the estate tax calculations.

- Complete Sections 1 and 2, which require reporting information about life insurance, jointly-owned property, and any trusts the decedent created. Follow the prompts carefully to provide accurate details.

- In Section 3, report the property and proceeds pertinent for Connecticut estate tax purposes. Be precise in detailing each item’s description, fair market value, and the amount passing to a spouse if applicable.

- For Section 4, calculate and enter the total gross estate value, considering all items listed in the previous sections. Make sure your totals reflect accurate addition from all previous calculations.

- Finally, review the declaration at the end of the form. Signature requirements apply, so ensure a fiduciary or authorized representative signs and dates the form before submission.

- After completing the form, save your changes. You will have the option to download, print, or share the form as necessary.

Complete your estate documentation online to ensure compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Probate Fees Probate fees fall into four principal categories: Filing fees. For all matters other than decedents' estates and accountings, the petitioner pays a filing fee for each petition, application or motion. The current fee is $150 and will increase, for most matters, to $225 on January 1, 2016.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.