Loading

Get Ct Au-724 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT AU-724 online

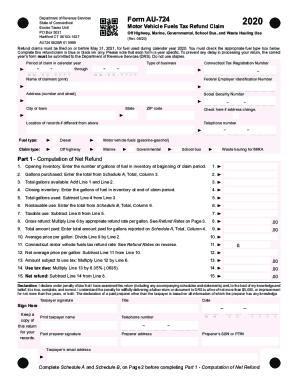

Filling out the CT AU-724 form is an essential process for claiming a motor vehicle fuels tax refund for specific uses in the state of Connecticut. This guide provides a clear and supportive step-by-step approach to help users navigate the online completion of the form.

Follow the steps to successfully fill out the CT AU-724 online.

- Use the ‘Get Form’ button to access the CT AU-724 online form and open it in your preferred digital editor.

- Begin by filling in the 'Period of claim in calendar year' section, specifying the start and end dates of your claim period.

- Indicate your 'Type of business' clearly.

- In the 'Name of claimant' field, print your full name as the individual making the claim.

- Provide your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) in the relevant fields.

- Complete your address details, including the street address, city, state, and ZIP code.

- If there has been an address change, check the corresponding box.

- Enter your Connecticut Tax Registration Number and your telephone number for contact purposes.

- Select the fuel type by marking the appropriate box for Diesel or Motor vehicle fuels (gasoline-gasohol).

- Choose the appropriate claim type by indicating whether it is for Off highway, Marine, Governmental, School bus, or Waste hauling.

- Proceed to Part 1 - Computation of Net Refund, entering your opening inventory of fuel in gallons and the total gallons purchased.

- Calculate the total gallons available by adding your opening inventory and gallons purchased.

- List the closing inventory of fuel in gallons at the end of your claim period.

- Calculate total gallons used by subtracting closing inventory from total gallons available.

- Complete the nontaxable use section by entering the total from Schedule B.

- Calculate the taxable use by subtracting nontaxable use from total gallons used.

- Determine the gross refund by multiplying nontaxable use by the refund rate per gallon as indicated.

- Enter the total amount paid for the gallons reported.

- Calculate the average price per gallon based on the data provided.

- Determine the net average price per gallon by subtracting the Connecticut motor vehicle fuels tax refund rate from the average price.

- Calculate the amount subject to use tax and the use tax due.

- Finally, compute your net refund by subtracting the use tax due from the gross refund.

- In the declaration section, sign and print your name, indicating your status as the taxpayer.

- If applicable, enter the information of a paid preparer, including their signature, title, and SSN or PTIN.

- Before submission, ensure that all schedules are completed and all necessary attachments, such as receipts, are included.

- Once completed, you can save changes, download, print, or share the CT AU-724 for your records.

Start the process of claiming your refund by completing the CT AU-724 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Underpayment Penalty occurs when a taxpayer uses IRS Form 2210 to calculate the amount of taxes he or she owes, subtracting the amount already paid in estimated taxes throughout the year. ... A taxpayers total tax liability is less than $1,000. The taxpayer did not owe any taxes for the previous year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.