Loading

Get Pa Ls-1 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA LS-1 online

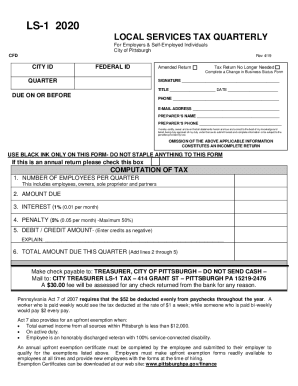

Filling out the PA LS-1 form online is a crucial step for employers and self-employed individuals in the City of Pittsburgh. This guide provides a detailed, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the PA LS-1 online effectively.

- Click the ‘Get Form’ button to access the PA LS-1 form and open it in the designated online editor.

- Enter your city identification number and federal identification number in the specified fields at the top of the form.

- Indicate whether you are submitting an amended return or if the tax return is no longer needed by checking the appropriate box.

- Fill in the quarter for which you are filing the return, ensuring accuracy in dates.

- Provide your contact information, including your phone number and email address, along with the preparer’s name and phone if applicable.

- Sign the form to certify that all provided information is true and correct, and date your signature.

- For the computation of tax section, list the total number of employees for the quarter on line 1, including all types of workers.

- Calculate the amount due and enter it on line 2, following the guidelines for the Local Services Tax as per Pennsylvania Act 7 of 2007.

- Complete the sections for interest and penalties, if applicable, on lines 3 and 4.

- Enter any credits on line 5, ensuring negative values for debits.

- Calculate the total amount due for the quarter by adding the amounts from lines 2 through 5, and enter the sum on line 6.

- Finalize your filing by either saving your changes, downloading the completed form, printing it for mailing, or sharing it as required.

Complete your PA LS-1 form online today to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The Local Services Tax (the LST ) is payable by all individuals who hold a job or otherwise work within a LST taxing jurisdiction. The employer withholds the tax, which is due quarterly on a prorated basis, as determined by the total number of payroll periods for the year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.