Loading

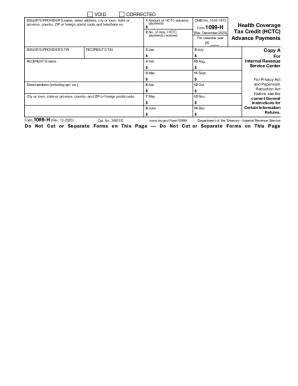

Get Irs 1099-h 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-H online

Filling out the IRS 1099-H form online is essential for reporting health coverage tax credit (HCTC) advance payments accurately. This guide provides clear instructions to help you complete the form with confidence, ensuring you capture all necessary details.

Follow the steps to fill out the IRS 1099-H online

- Click 'Get Form' button to access the IRS 1099-H form online.

- Enter the issuer's or provider's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the designated fields.

- In Box 1, fill in the amount of HCTC advance payments you received during the tax year.

- In Box 2, indicate the number of months you received HCTC payments.

- For Boxes 3 to 14, record the amount of HCTC advance payments for each month from January to December. Ensure that the total from these boxes matches the amount in Box 1.

- Provide the issuer's or provider's taxpayer identification number (TIN) and your own TIN in the appropriate fields.

- Complete the recipient's name and address details, including street address, city or town, state or province, country, and ZIP or foreign postal code.

- Review all entered information for accuracy before submitting.

- After finalizing the form, you can save changes, download, print, or share the completed IRS 1099-H form according to your needs.

Start filling out your IRS 1099-H form online today to ensure accurate tax reporting.

If you receive a Form 1099-MISC that reports your miscellaneous income and you don't include the income on your tax return, you may also be subject to a penalty. Failing to report income may cause your return to understate your tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.