Loading

Get Tx Form 50-129 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 50-129 online

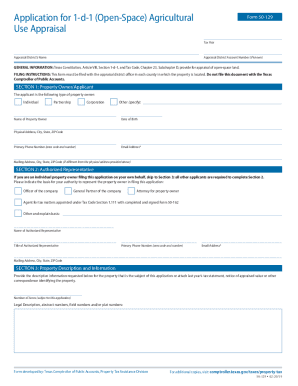

Filling out the TX Form 50-129, which is essential for applying for 1-d-1 (open-space) agricultural use appraisal, is a straightforward process when completed online. This guide provides clear, step-by-step instructions to assist users in navigating each section of the form.

Follow the steps to complete the online application effectively.

- Use the ‘Get Form’ button to access the form, which will open in your preferred online editor for easy completion.

- Begin with Section 1: Property Owner/Applicant. Carefully select the type of property owner from the provided options and enter your name, date of birth, physical address, primary phone number, email address, and mailing address if different.

- If you are not filing as an individual property owner, proceed to Section 2: Authorized Representative. Indicate your authority to represent the property owner and fill in your details, including your title, contact information, and mailing address.

- Move on to Section 3: Property Description and Information. Enter the number of acres related to this application and provide the legal description of the property. Respond to all the questions regarding ownership changes and previous appraisals.

- In Section 4: Property Use, detail the agricultural use of your property. You will need to document current and past uses, list livestock or crops, and any government programs you are participating in.

- If applicable, complete Section 5: Wildlife Management Use, and list wildlife management practices as well as prior agricultural land use categories. Attach required documents if necessary.

- If the property has been converted to timber production, fill out Section 6. State whether appraisal as 1-d-1 land is desired.

- Finally, fill out Section 7: Certification and Signature. Ensure that all information is accurate, sign the form electronically, and include the date.

- Once you have completed the form, you can save the changes, download a copy for your records, print it out, or share it as needed.

Start filling out your TX Form 50-129 online today to secure your agricultural property appraisal!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A Texas Agricultural Tax Exemption can be used as a land owner uses their land for hay production, raising livestock or managing wildlife. ... Applicants are not eligible if they don't do these things on a regular basis including home gardening, horse racing or certain types of wildlife management and land conservation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.