Loading

Get Ky 51a111 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 51A111 online

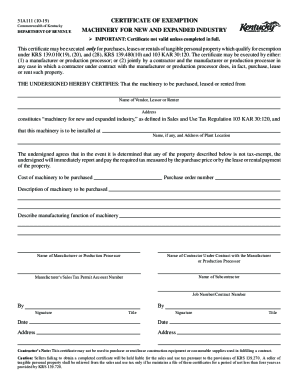

The KY 51A111 is a Certificate of Exemption used in Kentucky for purchases, leases, or rentals of machinery that qualifies for exemption from sales tax. This guide provides clear, step-by-step instructions on how to complete this form online accurately.

Follow the steps to complete the KY 51A111 online.

- Press the ‘Get Form’ button to access the KY 51A111 form and open it in your online editor.

- Complete the section labeled 'Name of Vendor, Lessor or Renter' with the appropriate information for the vendor supplying the machinery.

- Fill in the 'Address' of the vendor, ensuring complete accuracy for correspondence.

- In the section marked 'Name, if any, and Address of Plant Location,' specify where the machinery will be installed.

- Enter the 'Cost of machinery to be purchased,' followed by the 'Purchase order number' for the transaction.

- Provide a detailed 'Description of machinery to be purchased' and specify the 'Describe manufacturing function of machinery' to ensure clarity on its use.

- Complete the section on the 'Name of Manufacturer or Production Processor' along with the 'Name of Contractor Under Contract with the Manufacturer or Production Processor.'

- Include the 'Manufacturer's Sales Tax Permit Account Number' for identification purposes.

- Fill in the 'Name of Subcontractor' if applicable, along with the 'Job Number/Contract Number' to reference the project.

- Sign and date the form in the appropriate areas, ensuring all parties involved have done the same.

- After completing the form, utilize the options to save changes, download, print, or share the finalized document as needed.

Complete your KY 51A111 form online today and ensure your machinery purchases are tax-exempt.

Use tax is a sales tax on purchases made outside one's state of residence for taxable items that will be used, stored or consumed in one's state of residence and on which no tax was collected in the state of purchase.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.